Opes Partner foresees a 1-year fixed mortgage rising to 7% in 2023, with potential declines to 4.5% by mid-2026. OECD warns of a slowing economy due to debt costs, falling home values, and reduced jobs, impacting GDP. Housing market slowdown poses challenges, possibly leading to increased mortgage rates.

*Disclaimer: This article is intended to serve as an informative resource to help readers navigate the dynamic landscape of mortgage rates. While we provide insights and analysis, it’s important to note that predicting exact future rates is simply not possible.*

Current Economic Conditions Affecting Mortgage Rates in New Zealand

The determination of mortgage rates hinges on a multitude of factors, encompassing elements such as the Official Cash Rate, inflation, GDP, employment data, and Global events. Let us see how those are faring right now.

Official Cash Rate

Now, there’s something called the Official Cash Rate (OCR). Think of it as a knob that the Reserve Bank of New Zealand (RBNZ) turns to decide how cheap or expensive it is for banks to borrow money. In August, they set it at 5.50%. This affects how much interest banks charge for loans and how much they pay on deposits. Because of this, the usual interest rate for flexible loans in August is 8.50%, and for loans fixed for one year, it’s 7.09%.

The RBNZ holds significant power in shaping how much mortgage rates cost. By looking at what the RBNZ decides, we can get hints about how mortgage rates might change. If the RBNZ makes rules that make borrowing money more expensive, then mortgage rates could go up. On the other hand, if they do things that make borrowing money easier, mortgage rates might go down. Paying attention to what the RBNZ does can help us understand which way mortgage rates could go.

Inflation

In New Zealand’s current economy, the price of things, known as inflation, increased by 6% in July 2023. That’s slower than the 7.2% increase we saw since mid-June 2022. We measure this with the Consumer Price Index (CPI), which checks how much the cost of goods and services changes.

Inflation is a key factor in how the RBNZ decides on the Official Cash Rate (OCR). When prices of things rise a lot (high inflation), the RBNZ might raise the OCR to slow down spending and control prices from going crazy high. On the other hand, if prices are rising slowly (low inflation), the RBNZ might decrease the OCR to encourage borrowing, and spending, and make the economy grow. So, when the OCR changes, it’s like a tool the RBNZ uses to handle inflation and keep the economy steady.

GDP

Around June, everything the country made and its services added to $385 billion. That’s what we call the Gross Domestic Product (GDP), and it helps us know how much stuff the country creates each year.

GDP shows how well the economy is doing. If the whole world’s economy or other countries’ economies are doing well, it can help keep our mortgage rates stable or even make them lower. When economies are strong, jobs are available, and people spend money, businesses grow, which can affect prices. But if the economy is slowing down or food prices are going up, mortgage rates might go higher.

Employment Data

In terms of jobs, about 69.8% of people who could work have jobs. That’s more than 28,000 people; only 3.6% of folks are looking for jobs but need help finding them.

Employment numbers show how well the economy is doing. If many people don’t have jobs (high unemployment), it means the economy might be slow. In this case, the RBNZ might lower the OCR to help. When the OCR is lower, borrowing money gets cheaper. This encourages businesses to grow and people to spend, making the economy stronger. When more people get jobs and the economy is doing better, the RBNZ could raise the OCR to avoid prices rising too fast. So, unemployment levels help the RBNZ make sure the economy is balanced.

Worldwide Economic Situation

Watching how other countries’ economies are doing can also help us get a sense of where New Zealand’s mortgage rates might be heading.

On March 16, 2022, the United States Federal Reserve took a significant step by changing the Federal Funds rate. This rate controls the interest banks charge for short-term loans and impacts how much it costs to borrow money. Changes in this rate have a ripple effect on various financial tools, like mortgages and credit cards, making them either more or less affordable.

The way different financial markets around the world are connected shows how much of an impact these choices have. It’s similar to how something your friend does can affect you. Just as shifts in US interest rates can create waves in international markets, they can also reach New Zealand.

The Federal Reserve’s action, combined with adjustments in New Zealand’s Official Cash Rate (OCR), made waves in the banking system. This made borrowing money more expensive, ultimately leading to higher mortgage rates.

Recent Actions and Communications by the Reserve Bank of New Zealand

Remember the Official Cash Rate (OCR)? It directly affects how much banks need to pay to borrow money, changing the interest rates they offer to people who want mortgages. So, having a handle on these signs helps us guess and comprehend why mortgage rates go up or down.

Under the Policy Targets Agreements (PTA), the Reserve Bank of New Zealand operates under the mandate of maintaining annual CPI increases between 1% and 3%, targeting future inflation rates around 2%. In this context, Chief Economist Paul Conway led a statement confirming that the Official Cash Rate (OCR) would remain unchanged at 5.5%. This decision is aimed at balancing excessive spending and preventing unwanted price hikes.

Parts of the economy, such as businesses sensitive to interest rates, have experienced a slowdown. High borrowing costs have discouraged borrowing, resulting in slow job growth. Additionally, global economic challenges have hindered New Zealand’s exports, impacting its trade balance. While this has both positive and negative implications, the Reserve Bank’s stance is to maintain a higher lending rate to mitigate inflation risks.

Balancing the diverse economic elements is a complex endeavor as the Reserve Bank strives to achieve the dual objectives of controlled inflation and increased employment. The present fluidity of economic conditions underscores the Reserve Bank of New Zealand’s efforts to ensure economic stability.

Predictions from Financial Experts on Mortgage Rates

Opes Partner, a property investor who knows about buying and owning homes, predicts the cost of a 1-year fixed mortgage will go up to 7% in the year 2023. After that, they think it will slowly become less expensive over the next few years. By the middle of 2024, they believe it will be around 6%. Then, in the middle of 2025, it might go down to 5.5%; from around the middle of 2026, it could be as low as 4.5%.

The Organisation for Economic Co-operation and Development (OECD) says that the economy might slow down. This could happen because Real GDP, which is a measure of all the things we produce and do, might be affected by rising debt costs, falling home values, and fewer jobs available. OECD also mentions that inflation will slow but remain above the target of 1-3 percent before falling further in 2024.

However, the housing market slowdown presents problems. Borrowers may struggle to repay their debts, leading to increased interest rates. This can help control rising prices but may also increase mortgage rates.

*Disclaimer: While experts can provide insights and analysis, it’s important to note that predicting exact future rates is simply not possible.*

Historical New Zealand’s Mortgage Rate Trends

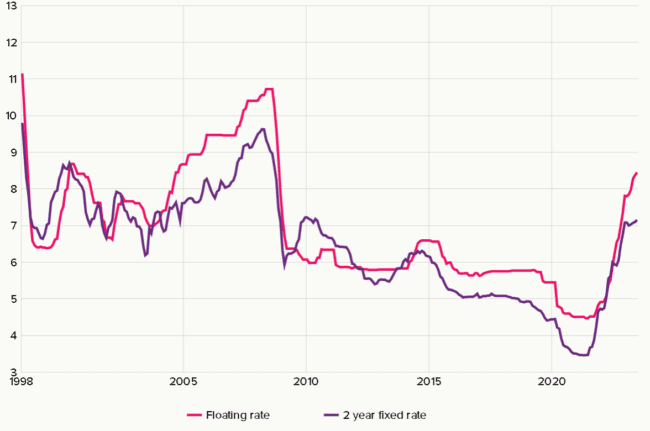

Starting from June 1998, the average Reserve Bank of New Zealand (RBNZ) floating rate has hovered around 6.90%. Notably, the rate reached its lowest point at 4.50% in October 2020. Conversely, the highest recorded rate was 11.20% in June 1998.

(Reserve Bank Of New Zealand, 2022)

In the two-year fixed rates, the RBNZ’s data reveals an average of 6.47% since June 1998. This period saw a record low of 3.50% in November 2020 and a peak of 9.80% in June 1998.

Impactful Events and Economic Shifts Shaping Mortgage Rates

Economic Chaos in 2008

The 2008 Global Financial Crisis (GFC) greatly affected mortgage rates in New Zealand and the world. It began with problems in the US housing market and caused a big worldwide economic problem. This made people uncertain about the future, so they wanted safer investments like government bonds. This increased interest rates.

Central banks, including New Zealand’s Reserve Bank, tried to help by making official interest rates lower. They wanted to make the economy better and keep financial markets steady. However, the overall uncertainty during the GFC led to higher interest rates. This affected how much it cost to borrow money, including for mortgages.

During the GFC, mortgage rates in New Zealand went up to an average of 10%. This showed how the worldwide financial problems, uncertainty about the economy, higher risks, and difficulty getting money to lend combined to make borrowing money, especially for homes, much more expensive.

Pandemic Impact

The rise of the COVID-19 pandemic brought new difficulties to the economy and money systems. Banks around the world, including New Zealand’s Reserve Bank, quickly made interest rates lower to encourage borrowing and the economy. This was meant to help people and businesses deal with the tough times during the pandemic.

Because of this, mortgage rates went down a lot. The average rate, which was about 4% before the pandemic, went down by a lot. This was to help homeowners and people who wanted to buy homes during the uncertain times of the pandemic.

However, as the world economy started to get better and the pandemic got less severe, banks thought about making interest rates higher. They wanted to avoid having the economy go out of balance because rates were low for a long time.

As we move through 2023, the expectation of higher interest rates affects mortgage rates. Banks might choose to make rates higher to prevent the economy from getting too hot and prices from going up a lot. When interest rates are higher, borrowing money, including for mortgages, becomes more expensive.

To sum up, the pandemic made banks lower interest rates a lot, which made mortgage rates drop to around 4%. But as economies get better, there’s a chance that interest rates will go up again, which could make the average mortgage rate higher.

Anticipating Mortgage Rate Trends in 2023: Insights and Considerations

As we look ahead to what might happen with mortgage rates in 2023, we can imagine two possibilities: rates going up or rates going down. These two options capture the mix of different things that can influence how mortgage rates change.

Scenario 1: Rising Mortgage Rates in 2023

1. Federal Reserve’s Money Strategy: If the US Federal Reserve chooses to make it harder for banks to borrow money, they might do this because they are worried that prices might increase too much or because they want to make things normal after keeping them easy for a while. If this happens, banks might decide to make people pay more interest when they want to borrow money to buy homes.

2. Prices Going Up and Economy Growing: If the economy is doing really well and things start getting more expensive (prices rising), lenders might want more money back when they lend it out. This can happen when the economy is growing a lot, and people are spending a lot, which can make interest rates, including mortgage rates, go up.

3. The World Economy: As we talked about earlier, how other countries are doing economically can also change mortgage rates. If other countries do well, people might send their money there, which can cause interest rates in the US to go up, and that can lead to higher mortgage rates here.

Risks and Uncertainties Shaping This Scenario

1. Changing the Plan: If the Federal Reserve’s plan to make things harder doesn’t match how the economy is really doing and it causes problems, they might change their minds. They could decide to do things differently to help the economy, which could stop mortgage rates from going up too much.

2. Surprises: Sometimes, things happen that we didn’t expect, like problems between countries or big natural disasters. When these things happen, people might get scared and want to put their money in safer things like bonds, which can actually lower rates even when they are supposed to go up.

3. What People Feel: People who put their money in different places can change their minds quickly. If they start to worry about things like politics or if the stock market goes down, they might move their money to safer things like bonds. This can make mortgage rates go down even when other things say they should go up.

Scenario 2: Declining Mortgage Rates in 2023

1. Helping the Economy: If the US economy is not doing well, the Federal Reserve might decide to make it cheaper for banks to borrow money. This can encourage people to borrow and spend more, which can help the economy. Lower borrowing costs can also lead to lower mortgage rates.

2. Global Challenges: When there are problems around the world, people often want to put their money in things that are safer, like US government bonds. This can make more people want to buy these bonds, and this can make interest rates go down, including mortgage rates here in New Zealand.

3. Keeping Prices Steady: If prices aren’t rising too much, the Federal Reserve might not feel the need to raise rates. This can help keep mortgage rates lower.

Risks and Uncertainties Shaping This Scenario

1. Running Out of Space to Lower Rates: If interest rates are already really low, the Federal Reserve might not be able to make them much lower. They might need to come up with new ideas to change mortgage rates.

2. Economy Getting Better Quickly: If the economy suddenly gets a lot better, people might start worrying about prices going up a lot. This might make the Federal Reserve change its plan and decide to make rates higher instead of lower.

3. Unexpected Prices Going Up: Sometimes, things happen that we don’t expect like things getting more expensive fast. This might make the Federal Reserve want to make rates higher to control these price jumps.

Remember, both scenarios include more than just borrowing money’s cost. Other things like how many people want to buy houses, how many houses there are, and what the government is doing also matter. And unexpected things, like new diseases, how we trade with other countries, or big tech improvements, can make it hard to know what will really happen to mortgage rates in 2023.

Guidance for Homeowners: Strategies Amidst Uncertainty

Navigating the tricky world of changing mortgage rates needs smart planning. Here are ideas to think about:

1. Flexible Money Plans: Get ready for different mortgage rates by making a money plan that can change. Keep an emergency fund in case rates go up unexpectedly. Also, set aside money for things that might cost more if your mortgage payments go up.

2. Paying More: Think about putting extra money on your mortgage when you can. This can help you pay back the loan quicker and give you more money options.

3. Changing Your Bank: Look into changing your loan provider if rates are going to go up. Banks might offer you a better rate to get your business. Getting a lower interest rate can save you lots of money over a long time.

4. Fixed or Flexible Rates: Consider the benefits and drawbacks of fixed and flexible interest rates. Fixed rates stay the same but might not get cheaper. Changing rates can be flexible but could mean paying more if rates go up.

5. Talking to Experts: While you work out all this mortgage rate stuff, talking to money experts or mortgage advisors can really help. These pros can look at patterns, give you personal advice, and help you make smart choices for your money goals.

Conclusion

In the world of mortgage rates, one thing always happens: things change. The mix of economic indicators, worldwide happenings, and government rules creates a moving picture that decides how mortgage rates go up or down.

As we go through 2023, being okay with not knowing everything but still getting info and ready will really help you deal with this journey. Your money choices, made with smarts and care, will be a big part of how you handle these always-changing mortgage rates.

Reference

- https://www.cnbc.com/2022/03/16/federal-reserve-meeting

- https://www.stats.govt.nz/news/annual-inflation-at-7-3-percent-32-year-high/

- https://www.stats.govt.nz/information-releases/labour-market-statistics-june-2023-quarter/

- https://www.stats.govt.nz/indicators/gross-domestic-product-gdp/

- https://mortgages.co.nz/mortgage-rates/

- https://www.opespartners.co.nz/property-markets

- https://www.rbnz.govt.nz/statistics/series/exchange-and-interest-rates/new-residential-mortgage-standard-interest-rates

- https://www.rbnz.govt.nz/monetary-policy/about-monetary-policy/the-official-cash-rate

- https://www.rbnz.govt.nz/monetary-policy/about-monetary-policy/inflation

- https://www.rbnz.govt.nz/statistics/key-statistics/housing

- OECD