Determine goals & risk tolerance to make informed choices when selecting financial assets for investments.

Before you answer that question, knowing what you want to achieve with your investment is really important. You need a roadmap for your money. Short-term goals like saving up for a fun vacation or buying a car and long-term goals like making sure you have enough money for retirement, buying a house, or helping your child with their education. Being clear about these goals helps you decide how to invest your money to make them happen.

Another factor is Volatility tolerance. This is understanding how comfortable you are with your investments moving around in value. It’s a vital thing to figure out because it affects how you decide to invest your money. If you’re okay with taking on more volatility, you might put more of your money in stocks, which can go up and down a lot but have the potential for higher returns. On the other hand, if you think volatility may stress you out too much, you might lean towards investments like bonds or other steady options that don’t swing as much.

Determine Your Investment Horizon and Budget

Your investment horizon is the timeframe during which you plan to keep your money invested. Your goals and the time available to achieve them determine whether your investment horizon is short-term (e.g., 1-3 years), medium-term (typically 3-5 years), or long-term (such as ten years or more). For instance, if you’re saving for retirement, you’re looking at the long term because you won’t need that money for quite a while. This extended horizon enables you to navigate the ups and downs of the investment markets along the way.

Creating an investment budget is super important when planning your finances. It’s like deciding how much you can comfortably spend on your investments without hurting your day-to-day life. First, make sure you’ve covered your essential expenses and set aside some money for emergencies. Once that’s done, determine how much you can regularly put into your investment account. This budget is your roadmap for reaching your financial goals over time.

Develop a Diversified Asset Allocation Strategy

Diversifying your investments is like having a balanced diet. Just as you wouldn’t eat only one type of food, you shouldn’t put all your money into one type of investment. Different investments can perform differently in the financial world.

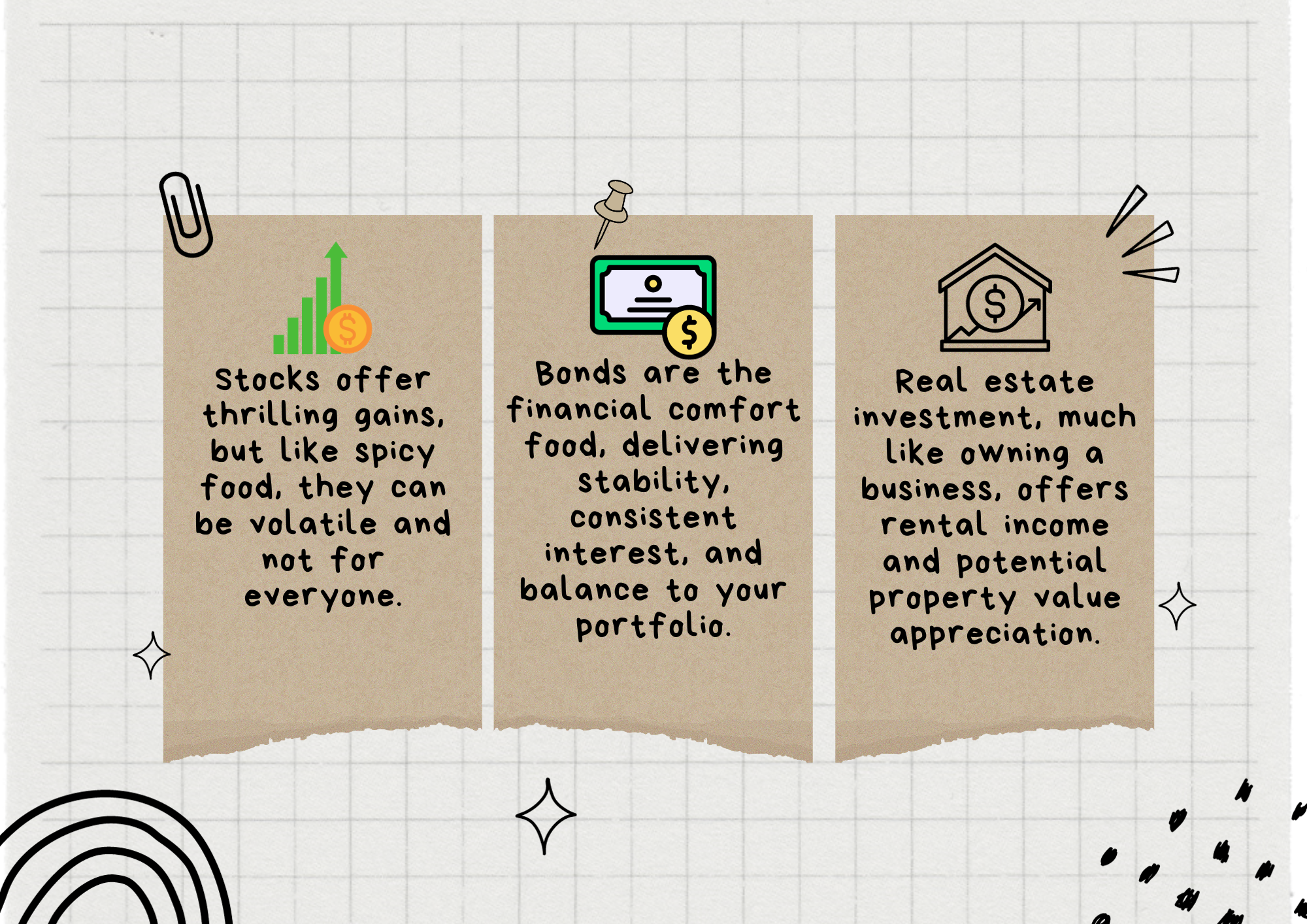

- Stocks can be the adventurous and exciting part of your portfolio. They have the potential for significant gains, like the thrill of trying new and potentially high-reward dishes. However, they can also be volatile, like spicy foods that might not sit well with everyone.

- Bonds are the stable and dependable part of your portfolio. They’re like comfort food, offering consistent interest payments and the return of your principal. While they may not provide the same excitement as stocks, they can provide security and balance to your financial menu.

- Real estate investment refers to owning property or having a stake in a real estate project. It can be likened to owning a restaurant or investing in a piece of a shopping mall. Real estate can generate rental income, like running a business, and appreciate over time, much like the value of real estate properties.

By combining these different investments, you’re creating a balanced meal for your financial health. If one part of your portfolio isn’t performing well, the others can help compensate for any losses.

Research and Select Specific Investments:

Imagine you’re in a store filled with various products and have money to spend. You want to ensure you pick the best things to serve you well. This is similar to investing, where you have a range of options to choose from, like different items on store shelves.

You should thoroughly research your investment choices like you’d read product labels and reviews in a store. This means looking into what each investment does and how it works. For example, you might come across stocks like buying a piece of a company. Bonds are more like lending money and getting paid interest in return. Real estate investments involve owning a piece of property, like owning a house or an apartment.

You want to understand these investment options so you can make an informed choice. It’s like reading the fine print and understanding what you’re getting before purchasing. Just as you wouldn’t blindly grab items off the store shelves, you shouldn’t blindly allocate your money without understanding the nature and potential returns of your investments.

Understanding Historical Performance:

Think about it this way: when you buy a phone or a car, you often check its track record. You want to know if it’s reliable and has a good history. Similarly, with investments, you should look at how they’ve performed in the past. Some investments may have had big ups and downs, like a roller coaster, while others may have been more stable.

Understanding historical performance helps you understand how an investment might behave in the future. While past performance doesn’t guarantee future results, it can give you valuable insights.

Considering Potential Risks:

Just as you’d think about a car’s safety features, you should consider the risks associated with each investment. Some investments come with more potential for gains but also more potential for losses. It’s like choosing between a sporty sports car and a safe sedan. The sports car can be exciting but riskier, while the sedan is more reliable and stable.

By understanding the risks, you can match your investments to your comfort level. If you’re okay with some bumps in the road, you might lean towards riskier investments. If you prefer a smoother journey, you might opt for safer options.

Watching Out for Associated Fees:

Just like when you buy something, there are often costs involved. These costs can eat into your profits. Think of them like maintenance fees for a car. The more you pay in fees, the less you get to keep for yourself. Before you invest, it’s crucial to understand any fees or costs associated with each investment. This way, you can ensure you’re not paying more than needed.

Choose an Investment Strategy and Stay Disciplined:

Investing can be like planning a road trip. You’re embarking on a journey, and you have a clear destination in mind: your financial goal. Just as you need a reliable route and a GPS to guide you on a road trip, you need an investment strategy to reach your financial destination. But it’s not just about choosing the right path; it’s also about staying on course and not getting sidetracked by impulsive decisions.

Selecting an Investment Strategy Aligned with Your Goals:

Imagine you’re planning a trip. If you aim to reach a specific city, you’ll pick the most direct and efficient route. Similarly, your investment strategy should match your financial goals.

- Buy and Hold

Consider this the highway option for your road trip. When you choose to “buy and hold” in investing, you pick a straightforward and steady route. You purchase investments, like stocks or bonds, and hold onto them for long, often years or even decades. It’s like cruising on the highway at a consistent speed, knowing that you might encounter some bumps but confident that you’re heading in the right direction.

This strategy works well for long-term goals, like retirement or funding your child’s education, where you have plenty of time to reach your destination. You’re not too concerned about minor detours, like temporary market fluctuations, because you’re focused on the ultimate goal.

- Value Investing

Picture this as a savvy shopper when planning your road trip. Just as you might look for discounts and deals, value investors search for undervalued investments in the financial market. These investments are like hidden gems waiting to be discovered.

Value investing entails the diligent research and selection of assets that seem to be undervalued. In some ways, it’s like discovering that cozy bed-and-breakfast on your road trip, where you find exceptional comfort at an affordable rate. This approach demands more effort and patience but can yield significant rewards over time.

Remember, your investment strategy is like choosing the best route to your destination. You want it to align with your financial goals and the time you have to reach them. Just as you’d pick the highway for a quicker journey or opt for value lodging to save money on your road trip, your investment strategy should suit your financial objectives and the level of effort you’re willing to put in. You set yourself up for a successful financial journey by selecting the right strategy.

Regularly Monitor and Adjust Your Portfolio:

Imagine your investment portfolio as a garden. You’ve chosen different types of investments, like different kinds of plants, that you hope will grow nicely over time. Just like gardens, portfolios need regular care and attention to do well.

Periodically Review Your Portfolio:

Imagine you’ve planted a garden full of different plants, each with unique needs. Some need more sunlight, while others thrive in the shade. Over time, these needs might change, just as your financial goals can evolve.

That’s why it’s important to check on your investments periodically. Think of it as inspecting your garden to see how each plant is doing. Are some growing too fast, while others seem to be struggling? In the same way, you want to ensure that your investments are aligning with your financial goals.

Rebalance as Needed to Maintain Your Desired Asset Allocation:

Just as your plants grow and may need rearranging or trimming to maintain a healthy garden, your investing journey involves similar considerations. Your investments can evolve over time, much like how your garden’s plants might change. For instance, if your investments in stocks perform exceptionally well, they might become a dominant part of your portfolio, potentially increasing its risk beyond your original intentions.

In the world of investing, this process is known as rebalancing. It entails adjusting your investment portfolio to uphold the mix of investments (asset allocation) aligned with your financial goals and risk tolerance.

Imagine you initially aimed for a 60% stocks and 40% bonds mix in your portfolio, but due to the stock market’s growth, it has shifted to 70% stocks and 30% bonds. To rebalance, you’d sell some stocks and invest more in bonds to return to your desired 60/40 mix.

By regularly reviewing and rebalancing your portfolio, you’re essentially tending to your financial garden. You make sure your investments work in harmony with your objectives and risk tolerance. Just as you wouldn’t allow your garden to become overgrown and unruly, you don’t want your portfolio to become imbalanced and potentially risky. Consistent care and adjustments can help you stay on track toward your financial destination while nurturing your investments.

Seek Professional Advice and Stay Informed:

Navigating the world of finance can sometimes feel like exploring a foreign land. That’s why, just as you might hire a local guide when travelling to unfamiliar places, seeking professional advice when managing your investments can be beneficial. Additionally, staying informed about what’s happening in the financial world is like keeping an eye on the weather forecast during your trip to ensure smooth sailing.

Consider Consulting a Financial Advisor for Personalized Guidance:

Imagine you’re on a journey to a new destination, and you’re not familiar with the local customs, language, or terrain. In this situation, you’d likely hire a knowledgeable guide who can provide personalized advice and help you navigate effectively.

Similarly, a financial advisor can be your trusted guide regarding your investments. To create a tailored plan, they assess your unique financial goals, risk tolerance, and overall situation. It’s like having a roadmap designed specifically for your journey, helping you make informed decisions along the way.

Stay Informed About Market Trends, Economic Developments, and Investment Changes:

Now, picture yourself on that journey with your guide. Along the way, you might encounter changes in weather, road conditions, or local events. You’d want to stay informed about these developments to ensure a successful trip and adapt your plans accordingly.

In the financial realm, this means keeping an eye on market trends, economic news, and changes in the investment landscape. It’s like staying updated on the latest road closures, traffic updates, and local attractions during your journey. Staying informed allows you to make timely adjustments to your investment strategy and take advantage of opportunities or navigate around potential obstacles. By seeking professional advice and staying informed, you equip yourself with the tools and knowledge needed to make sound financial decisions.

For any other financial needs or questions, you can visit Money Advisers. Whether you’re looking for tips on saving or investing, Money Advisers can be a valuable destination for enhancing your financial knowledge and making informed choices.