Managing an inheritance wisely involves assessing finances, setting clear goals, creating an emergency fund, paying off high-interest debts, and investing strategically. Seek professional advice and avoid impulsive spending while adhering to a budget for responsible financial management.

Receiving an inheritance can be a life-changing event for many people, but figuring out how to manage it can be overwhelming and complicated. It may seem like the sudden lump sum of funds could solve all your money issues, but it’s important to acknowledge that it can also come with unforeseen challenges. Poor financial management can, in fact, make matters worse. This guide offers a structured plan to help you navigate the complexities of managing your inheritance wisely.

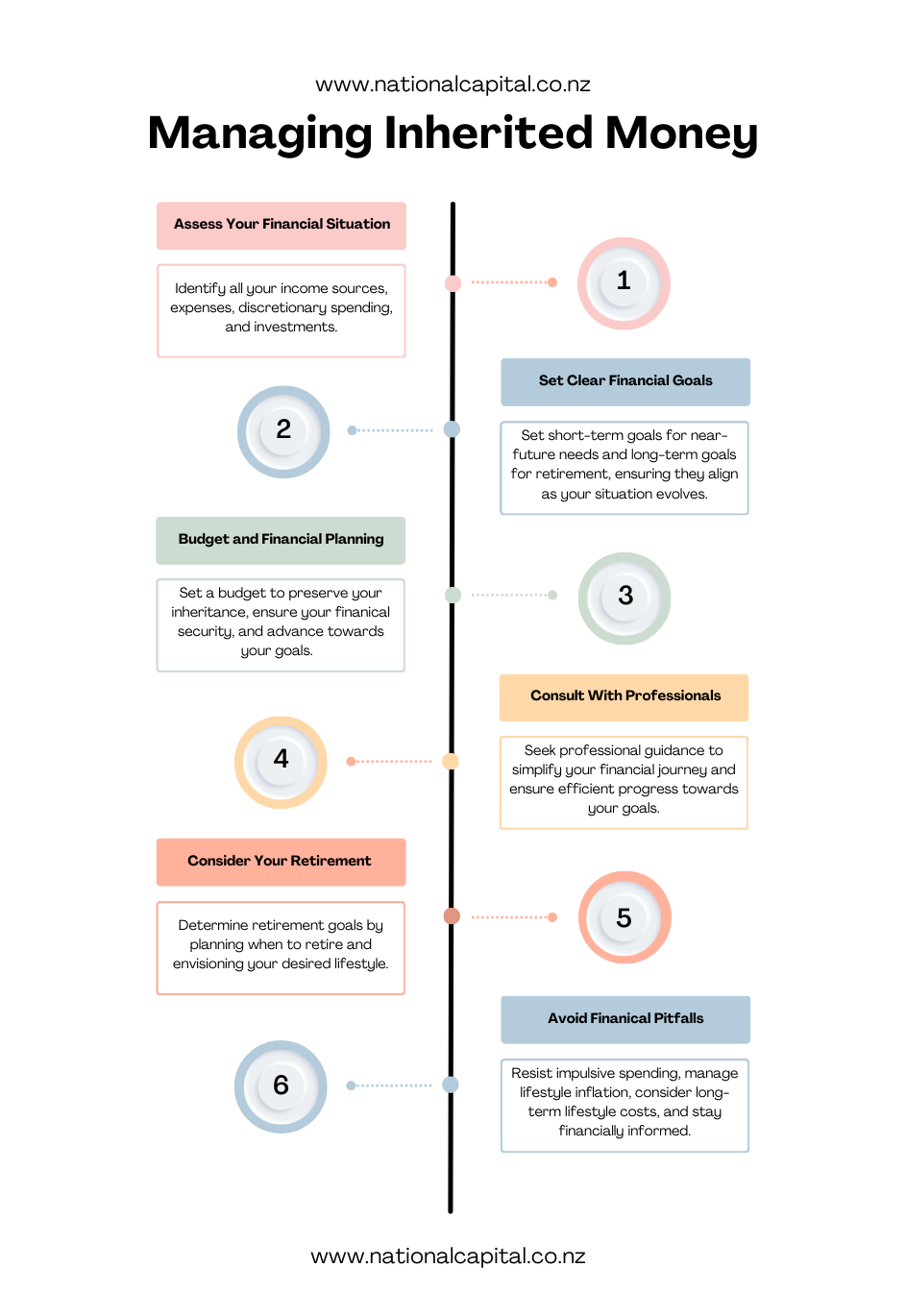

Assess Your Financial Situation

Income:

To start managing your finances effectively, it’s important to conduct a thorough analysis of all your sources of income. This includes taking into account your salary, any rental income you receive, dividends from investments, and any other incoming funds. By having a clear understanding of where your money is coming from, you’ll be better equipped to create a budget and make informed financial decisions.

Expenses:

It’s also crucial to analyse your monthly and yearly expenses thoroughly. This includes taking into account all your fixed costs, such as rent or mortgage payments, utility bills, groceries, transportation expenses, insurance premiums, credit card debts, and loan payments (such as student loans, car loans, and personal loans). Additionally, it’s important to consider your discretionary expenses, such as going out to that nice restaurant or watching that highly-anticipated movie with your mates.

Investments and Savings:

Lastly, is to evaluate your current investments and savings. This includes your retirement account (KiwiSaver), any real estate you may own, your emergency funds, short-term savings accounts, and any other valuable assets you may possess.

Set Clear Financial Goals

Short-Term Financial Goals:

When it comes to your money, short-term financial objectives are the goals you want to achieve in the next few years. These are usually things you need to pay for soon or things that are really important to you. For example, one common short-term goal is to save enough money for a down payment on a house. This means putting away a certain amount of money for a set amount of time so you can buy a house in the future. Another short-term goal might be to have a “rainy day” fund for unexpected expenses so you don’t have to take money out of your long-term savings. These short-term goals are fundamental because they help you build a good foundation for your finances.

Long-Term Goals:

Long-term goals, on the other hand, are focused on the future and involve planning for financial milestones that are several years or even decades away. A good example of a long-term objective is investing in something like KiwiSaver for retirement. This means putting aside some money from your income now so that you can have financial security and independence when you retire. Another example might be saving up for your child’s education, which can take many years of consistent saving and investing to achieve. Long-term objectives require careful planning and discipline when it comes to building up your wealth over time.

Aligning Your Goals:

It’s important to keep in mind that your financial goals for the near and distant future are connected and should work together to achieve your overall financial dreams. For instance, if you want to retire comfortably in the future, your short-term goals could include regularly putting money into your retirement accounts or paying off debts with high-interest rates so you have more money to invest in the long term. These goals should be adjustable as your financial situation changes over time.

Budget and Financial Planning

Preservation of Wealth:

Managing a large sum of money can be challenging, especially when it comes to an inheritance. To make sure that you can use the money wisely and make it last, it’s a good idea to create a budget. A budget helps you to organise your spending and make informed decisions about how to allocate your inheritance. By doing so, you can protect and preserve your wealth for a long time and even pass it on to future generations.

Financial Security:

Having a budget is crucial for your financial stability and peace of mind. It helps you cover your necessary expenses, such as housing, food, utilities, and healthcare, while also allowing you to plan for unexpected emergencies. Without a budget, you may find yourself struggling to make ends meet once you’ve spent your inheritance.

Avoid Impulsive Spending:

A budget also helps you control impulsive spending behaviour that can occur when you receive a windfall like an inheritance. Without a budget, you may be tempted to make extravagant purchases or engage in excessive discretionary spending, which can lead to financial difficulties down the road. Instead, a budget can help you stay focused on your long-term financial goals and avoid overspending.

Meet Financial Goals:

In addition to controlling your spending, a budget can also help you achieve specific financial goals. Whether you want to save for retirement, buy a home, fund your children’s education, or invest for the future, a budget helps you allocate your resources systematically and work towards these objectives.

Avoid Financial Pitfalls:

Finally, having a budget can help you avoid common financial pitfalls like overspending or making hasty investment decisions. By providing a roadmap for your financial journey, a budget can help you navigate potential pitfalls and make informed decisions about your money.

Consult With Professionals

Customised Financial Planning:

Finance Advisors can look at how much money you make, how much you spend, and what you want to achieve and then create a plan that’s just for you. They can also assist you with deciding where to invest your money so that you can get the most out of it while keeping in mind the rules of New Zealand’s financial system. Additionally, they can help you manage the risks involved in investing your money.

Local Expertise:

It’s crucial to have guidance from someone who is located in New Zealand and has a good understanding of the country’s financial and legal environment. Such professionals can offer you personalised advice based on your situation and keep you informed about any updates in the country’s tax code or estate laws.

Regular Review and Updates:

Financial advisors are professionals who keep a close eye on your money and investments. They make sure that your investments are doing well and adjust them as needed to help you reach your financial goals. With a financial advisor, you can have peace of mind knowing that someone is always looking out for your financial health and helping you plan for a secure future.

Cost Considerations:

Investing in professional financial advice may require you to spend some money, but it’s definitely worth it in the long run. Think of it as an investment in your financial security. With the right guidance, you can avoid costly mistakes, save money, and protect yourself from any issues that may arise.

Consider Your Retirement

Assess your Retirement Goals:

Before you think about putting any part of your inheritance into KiwiSaver, take some time to figure out what you want your retirement to look like. When do you plan on retiring, and what kind of lifestyle do you want to have? How much will it cost to maintain that lifestyle? Once you have answers to these questions, you can figure out how much you need to save up for your retirement.

Maximising KiwiSaver Benefits:

Saving for your future is really important, and there’s a great tool available to help you called KiwiSaver. If you have a job, your employer is required to contribute a minimum of 3% of your pay to your KiwiSaver account. On top of that, the government chips in 50 cents for every dollar you contribute, up to a maximum of $521.43 per year – a no-brainer, right? So, if you’re looking to secure a more comfortable retirement, it’s smart to consider adding a portion of your inheritance to your KiwiSaver account.

Consult a Financial Advisor:

If you’re not sure how much to put into KiwiSaver or what scheme to invest in, it’s a good idea to talk to a financial advisor. They can help you figure out what’s best for you based on your financial situation and what you want your retirement to look like.

If you’re looking for trustworthy advice on managing your money, you might consider reaching out to National Capital. We specialise in retirement planning and can give you guidance on your KiwiSaver scheme and retirement goals. Our KiwiSaver HealthCheck is free and only takes a few minutes to ensure you’re on the right track in making the most out of your retirement goals.

Avoid Financial Pitfalls

Understanding how easy it is to lose your money:

Getting a lot of money all of a sudden, like winning a lottery, can feel like a dream come true. But did you know that around 70% of lotto winners end up in a tough financial spot within five years or less? More often than not, that’s because they spend all their money and don’t plan for the future. This shows how important it is to be responsible with your money and plan wisely when you get a lot of money at once.

Impulsive spending:

Receiving a sudden financial windfall can be exciting, but it can also lead to overspending. When people suddenly come into a lot of money, they might feel like they can buy anything they want without thinking about the consequences. This can cause them to make expensive purchases on a whim, like buying luxury items or upgrading their lifestyle in a big way, without considering how it will affect their finances in the long run. Unfortunately, this can quickly eat up the windfall and leave them worse off than before. The temptation to spend all the money right away can be strong, but it’s important to think about how to use it wisely to avoid financial problems later on.

Relying on a single investment:

When you come into possession of a lot of money, it might be tempting to put it all into one investment and hope for the best. But this can be really risky because if that investment doesn’t do well, you could lose a lot of money and put your financial security in danger. It’s like the saying, “Don’t put all your eggs in one basket.” On the other hand, if you spread your money out and invest in different things, like stocks, bonds, and real estate, you’re protecting yourself from losing everything if one investment doesn’t do well. This is called diversification, and it’s something everyone should do to ensure their financial security.

Generosity to a Fault:

When you suddenly receive a large sum of money, it’s common for family and friends to ask you for financial help or favours. However, it’s important to be careful and thoughtful in how you respond to these requests. Being too generous can quickly drain your funds and put your own financial security at risk. So, it’s important to think carefully about these requests and to only provide help that you can afford without endangering your own financial future. By being cautious and thoughtful, you can strike a balance between helping your loved ones and protecting your own financial well-being.

Lifestyle inflation:

When we get a sudden increase in money, like a big inheritance or a raise in our salary, we may feel tempted to start spending more money on fancy things like expensive clothes, cars or vacations. This is normal and okay, but it can become a problem if we start spending more than we can really afford. This is called “lifestyle inflation”, and it can lead to trouble because we might end up spending more than our financial means permit and get into debt. So it’s important to be careful and plan our spending based on our actual financial situation and long-term goals.

Underestimating Lifestyle Costs:

It’s not uncommon for people to receive a large sum of money and decide to upgrade their lifestyle without fully considering the long-term financial effects. This can happen when they buy a more expensive home, even if their current one is perfectly fine, which can lead to higher mortgage payments, property taxes, and maintenance expenses. Similarly, dining out frequently at fancy restaurants may be enjoyable in the short term, but it can add up to significant long-term costs and put a strain on one’s budget. These examples show that it’s important to make informed decisions and think about the broader financial implications of lifestyle enhancements.

Staying Informed:

It’s really important to know about personal finance, investments, and how the market is doing if you want to make smart choices with your money. If you don’t know much about these things, you might make bad decisions or miss out on opportunities to grow your wealth. To avoid this, you should spend time learning about money. You can read books, attend seminars or classes, and keep up with what’s happening in the news. When you know more about finances, you’ll be able to make better choices and avoid common money problems.

What do I do with the money?

For Everybody

Pay Off High-Interest Debts:

Assess Your Debt:

First, take a look at all the debts you currently owe that have high interest rates. This could include credit card balances, personal loans, or any other debt that has an interest rate much higher than what you could gain by investing your money elsewhere.

Prioritise High-Interest Debts:

Rank your debts according to the interest rates they charge, with the debt that has the highest interest rate at the top of the list. By doing this, you can concentrate on paying off the most expensive debts first, which can save you money in the long run.

Make Lump-Sum Payments:

Consider using some, even all, of your inheritance to pay off your high-interest debts all at once. This can help you reduce the amount you owe and save money on interest charges.

Advantages of Paying Off High-Interest Debts:

Interest Savings:

If you have debts with high interest rates, like credit card balances, they can cost you a lot of money over time. But, if you have recently received an inheritance, you can use some of that money to pay off these debts and save a lot of money on interest payments. This can help you free up more cash for other important financial goals.

Improve Cash Flow:

When you pay off high-interest debts, you can improve your monthly budget by freeing up money that you used to spend on interest payments. This extra cash can be used to start an emergency fund, save for retirement, or invest in opportunities with better returns.

Reduce Financial Stress:

Paying off these debts can also help you reduce financial stress and anxiety. High levels of debt can be a heavy burden, but once you get rid of these debts, you’ll feel better and more confident about your financial situation, leading to better overall mental and emotional well-being.

Create an Emergency Fund:

Setting Financial Goals:

To start saving for your emergency fund, you’ll need to decide how much money you want to have in it. While it’s generally recommended to have enough money saved to cover three to six months of expenses, it’s a good idea to take a closer look at your own situation and decide how much you need to save to feel secure.

Open a Separate Savings Account:

It’s always a smart move to have a separate savings account dedicated to your emergency funds. By doing so, you’re less likely to use the money for non-emergency situations. Having a separate account can help you keep your emergency funds safe and ready for when you really need them.

Advantages of Creating an Emergency Fund:

Financial Security:

Having an emergency fund is like having a financial safety net that can help you deal with unexpected expenses or emergencies that might come up. It’s an important part of your overall financial plan because it can keep you from having to take out high-interest loans or use up your long-term savings to cover unexpected costs. These situations can include things like medical bills, car repairs, house maintenance, job loss, or any other kind of unexpected event that needs a lot of money.

Think About Giving and Philanthropy:

Identify your Passions and Values:

Firstly, think about what’s important to you. What kind of things do you care about the most – is it education, healthcare, or something else? Once you’ve figured that out, try to identify some of the main issues that are associated with your chosen area. This could be things like poverty, environmental damage, or other big problems that you’d like to help solve.

Research Charitable Organisations:

When you know what causes you care about, you can find charities in New Zealand that support those causes. Look for charities that have a good reputation and a history of making a real difference in the areas that matter to you.

Benefits of Giving and Philanthropy:

Personal Fulfillment:

It’s important to understand that giving to charity can be a deeply satisfying experience. When you donate your inheritance to a cause that you care about, you can feel a sense of purpose and fulfilment knowing that you’re making a positive impact in the world. Donating even a small portion of your inheritance can have a significant impact.

Young Kiwis (Teenagers to Late Twenties)

Investing your inheritance:

Investing in your inheritance is an excellent way to grow and manage your wealth over time. Instead of allowing your inheritance to remain stagnant or be quickly spent, investing can not only preserve its value but also grow it over time. There are different types of investments to choose from, each with its own advantages and disadvantages.

Types of investments

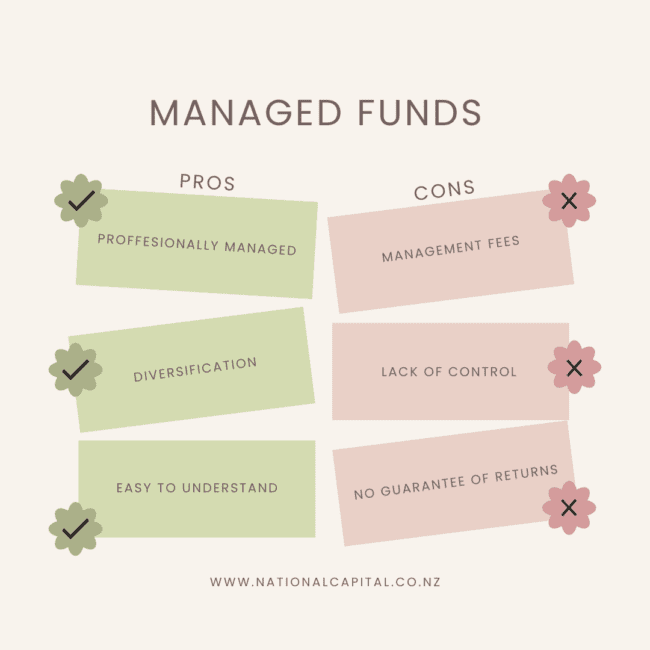

Managed funds:

A managed fund is a type of investment that is managed by professionals who invest your money in a variety of assets. This can help you to grow your money and manage risk without having to worry about choosing individual investments yourself. It’s a good option for people who want a hands-off approach to investing.

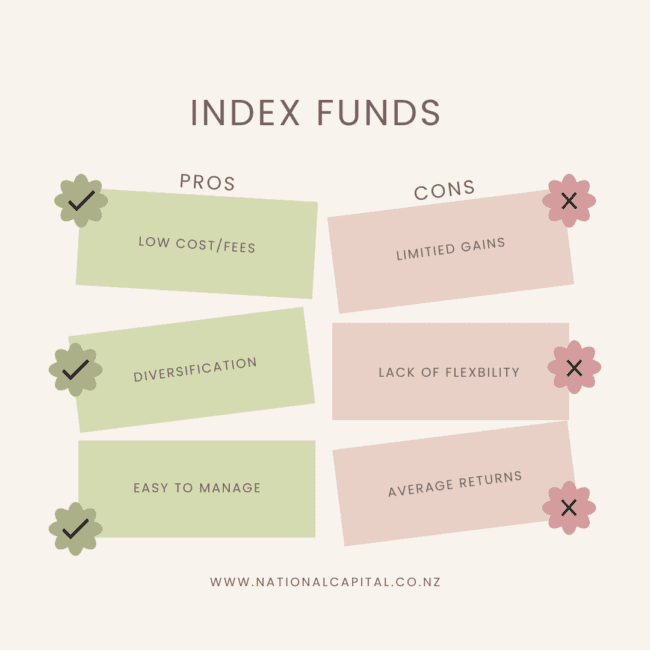

Index funds:

An index fund is a type of investment that tracks a broad market index, such as the NZX 50. This means you’re investing in a diverse range of companies, which can help to spread risk. It’s a good option for people who want a simple, low-cost way to invest in the stock market.

Stocks:

Investing in individual stocks means buying shares in a specific company. This can be a good option for people who want to participate in the growth of a particular company or who want to earn dividends. However, it’s important to remember that investing in individual stocks can be riskier than investing in managed or index funds.

Property:

If you’re looking for a way to invest your money, you might want to consider investing in property. Property investment offers a variety of benefits, such as the chance to earn money from renting out the property, the potential to earn more money in the long term, and the ability to protect your money against inflation. All of these benefits make property investment a great choice for anyone looking to build wealth and diversify their investments.

Middle-Aged Kiwis (Early Thirties to Early Sixties)

Pay off mortgage payments:

If you’re between your thirties and sixties and own a home, it’s a good idea to use your inheritance to pay off your mortgage. This can give you peace of mind and financial security and also remove a significant monthly expense. Doing this helps you have a more stable and comfortable financial future.

Investing your inheritance:

Even if you’re still years away from retiring, it’s a good idea to keep your money invested for as long as possible. The longer you keep your money invested, the more potential there is for it to grow. If you don’t have a mortgage or are comfortable with your current debt, you might consider investing a lump sum of money. There are many different ways to invest your money, and some are more tax-friendly than others. Two popular options are managed funds and index-tracking funds like the NZX 50 index.

Enjoying your inheritance:

If you’re happy with the way you’ve invested your money and would rather enjoy a large sum of cash now instead of waiting, there are many options available to you. In New Zealand, many people choose to use their money to improve their quality of life while they’re still in good health. This might mean renovating their home for a more comfortable retirement, taking a long vacation, or upgrading their car. These are all ways to make the most of your finances and enjoy life to the fullest. Of course, exercise caution in managing your expenses, as a substantial windfall can sometimes lead to imprudent spending and financial choices.

Retired Kiwis (Mid-Sixties)

Financial windfalls in retirement:

It’s not very common to receive a large sum of money during your retirement years, but it can be really helpful, especially if you’re not doing well financially. Most financial experts agree that retiring without enough money saved can make things difficult and uncomfortable. Plus, a lot of retired people struggle with figuring out how much they can spend without running out of money too soon. So, if you find yourself fortunate enough to come into a substantial sum, it’s often best to prioritise saving and investing it for retirement. This can ensure you have a more secure and comfortable retirement, allowing you to enjoy your golden years without financial worries.

Conclusion

To ensure that you make the most of your inheritance, it’s important to take a well-rounded approach that involves careful financial planning, goal setting, giving back to the community, and seeking expert advice. By following this approach, you can secure your financial future, work towards achieving your financial dreams, and leave a positive impact on the world that lasts beyond your lifetime.