In New Zealand, rising interest rates swiftly reshaped affordability. Homeowners must assess a "comfortable" limit, adapting to changes, ensuring stability, and considering all related costs.

Having a mortgage is like raising a child; it’s a long-term commitment. The first few years may feel manageable as you find a rhythm in managing your mortgage payments, just as you adapt to the routines of caring for a young child; however, much like how children grow and their needs change, a mortgage can evolve too. Rising interest rates in New Zealand have caused mortgage rates to increase.

In January 2022, the one-year average mortgage rates in NZ, calculated by the RBNZ, stood at 4.18%. However, within just one year, this figure climbed significantly to 6.68%. A home loan of $300,000 could result in your monthly mortgage payments jumping from $1,465 to $1932.

And just like that, what you once believed you could afford is no longer achievable!

When determining how much we can afford for a mortgage, the real question

we need to ask ourselves is, ‘How much can I comfortably afford for a mortgage?’

Knowing this helps you avoid overstretching yourself, ensures that you can consistently make your mortgage payments even if interest rates rise, and safeguards you from financial hardships.

Remember, when determining how much you can afford for a mortgage, you will not just be paying mortgage payments but other home costs such as insurance, taxes and additional fees.

_________________________________

A mortgage is a loan used to buy real estate, usually homes. For most of us, the enormous upfront cost of buying a house isn’t already sitting in our bank accounts. This is why we must rely on a lender, often a bank, to purchase a property. Your mortgage agreement is a promise to repay that money over a certain period, usually over many years.

_________________________________

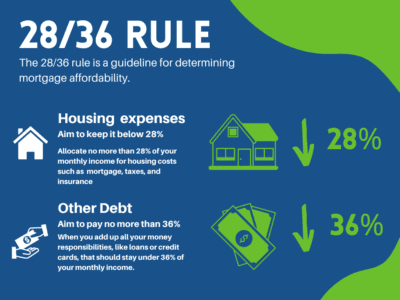

The 28/36 Rule for Mortgage Affordability

Here’s a general rule of thumb to determine how much you can comfortably afford to pay for all your home costs: Aim to keep these costs to about 28-36% of what you make monthly.

The 28/36 rule for mortgages is like a money guide to help you figure out how much to spend on your home. You should use, at most, 28% of the money you make each month to pay for your house stuff like the mortgage, taxes, and insurance. And then, when you add up all your money responsibilities, like loans or credit cards, that should stay under 36% of your monthly income.

However, this is only a general rule of thumb, and your affordability will ultimately depend on some additional factors.

Factors Affecting Your Mortgage Affordability

In New Zealand, the size of the mortgage you can handle depends on various factors, including:

1. Interest rates

2. Your income

3. Your expenses

4. The down payment

5. Government support (if eligible)

Considering your overall financial situation and budget is crucial to ensure you can comfortably manage your mortgage payments while meeting other financial goals and obligations.

Interest Rates

The fluctuating New Zealand housing market can significantly impact whether it’s a good time to get a mortgage and how much you can afford.

Think of the housing market as a teenager. Just as adolescents’ mood swings lead to unpredictable behaviour, the housing market experiences its version of mood swings through market fluctuations. These fluctuations lead to the rise and fall of interest rates caused by forces beyond our control, such as the economy and global conditions. Let’s break down what this means for you:

Interest rates are directly affected by market movements. Say you are ready to buy your first home and secure your mortgage, but you’ve heard on the news that interest rates are high. In a market with high interest rates, your monthly mortgage payments will also be increased, reducing your affordability.

To illustrate, In January 2022, New Zealand’s one-year average mortgage rates stood at 4.18%. However, fast forward to January 2023, and those rates have surged to 6.68%. How does this increase impact you?

Suppose you’re considering a house valued at $800,000. At a rate of 4.18%, your monthly mortgage payment equals $3,895.21. In a couple of years, the mortgage rate increases to 6.68% because of rising interest rates. Consequently, your monthly mortgage payment jumps to $5,164.36. This highlights how even a small change in interest rates can lead to substantial differences in monthly payments. High-interest rates put pressure on your budget, making it harder to keep up with your monthly mortgage payments.

It is important to remember that markets can be unpredictable. What’s affordable now might not be in a few months if prices or interest rates change. But remember, just like raising a teenager, as long as you have prepared for those mood swings, you will be well equipped to handle anything.

Your Income

When determining how much mortgage you can afford, you must evaluate your current financial situation.

Assessing your financial situation can feel like spring-cleaning your wardrobe. It can be a daunting task that makes you question all your choices in life. But in the end, you feel a lot better about yourself. Preparing for a mortgage is similar; you should only be taking on debt if you understand how much you make and how much you spend at the moment.

Firstly, determine all your sources of income, such as earnings from your primary and secondary jobs or any investments you may have. Take note of the consistency of your income streams each month. Income stability is vital, as lenders typically prefer consistent earnings. A higher and stable income boosts your borrowing capacity, as lenders will see you as a reliable custodian of their money.

“A higher and stable income boosts your borrowing capacity, as lenders will see you as a reliable custodian of their money.”

Your Expenses

Expenses can include routine bills to daily essentials. Categorize expenses into essential needs, like housing, utilities, and groceries, and discretionary spending, such as entertainment or dining out. This breakdown helps you understand where your money goes and identifies potential areas for cost-cutting or adjustment to accommodate mortgage payments. Mortgage lenders pay close attention to your spending habits as rash, and unjustified purchases can suggest an unreliable customer.

_________________________________

The CCCFA sets out guidelines that lenders are obligated to follow when providing you with a loan. This is to ensure that Kiwis are treated fairly and given clear information about their loan agreements. As of 4 May 2023, lenders will not be able to look at your discretionary spending, i.e. they won’t consider things you choose to spend money on, like going out to eat or entertainment. They’ll focus on your necessary expenses instead. Keep in mind that these regulations could be changed in the future.

_________________________________

Existing Debt

It can feel uncomfortable to face how much debt we have accumulated. Still, it is a crucial step in your financial assessment. Debt obligations include credit card balances, student loans, car loans, and any other outstanding loans. Evaluating your debt load aids in determining how much additional debt, such as a mortgage, you can reasonably handle.

By undertaking these steps, you will gain a clearer insight into your financial position, enabling you to understand how much mortgage you can comfortably afford.

Your Deposit or the money you put down upfront

The down payment/deposit is the money you pay upfront towards the purchase price of the home. A larger down payment means you’re borrowing less money, which significantly impacts your mortgage affordability. With a higher down payment, your monthly mortgage payments are generally lower because the loan amount is reduced. In most instances, a deposit of 20% of the home’s value is what you should aim for, as it will help you avoid the need for Private Mortgage Insurance (PMI).

A PMI cost is a super unnecessary payment that does not help you pay off your mortgage. If you have a deposit of less than 20%, you will likely need to pay this fee. It is just a safety net for the bank to ensure they will get their money back. So, make sure you start saving for that 20% down payment to avoid this expense.

In New Zealand, you can use your KiwiSaver as a down payment toward purchasing your first home. The KiwiSaver scheme offers a First Home Withdrawal option, allowing eligible members to withdraw a portion of their KiwiSaver funds to put towards buying their first home. You need to meet specific eligibility criteria and requirements to access your KiwiSaver funds for this purpose.

The guidance provided by the National Capital KiwiSaver advisers team can help ensure that you’re invested in the right fund that matches your goals of buying your first home.

Improving your Mortgage Affordability

Alright, you’ve done your financial assessment, and things aren’t looking too good. But don’t worry! All hope is not lost. Here are some tips to get your financial situation back on track.

Reducing Debt

Right now, you may be staring at the extensive amount of debt you have accumulated and wondering how a lender will be able to give you a reasonable rate on your mortgage. Nevertheless, It’s never too late to create a plan to reduce your debt.

- Debt Consolidation: Consider merging high-interest debts into a single, lower-interest loan. This can make your payments more manageable and save you money on interest.

- Snowball Method: The snowball method is a way of clearing from the smallest to the largest. This enables you to quickly clear small debts off your list so you can focus on the larger ones.

- Prioritize High-interest Debts: Focus on paying off debts with the highest interest rates first. This will save you money in the long run and help you become debt-free faster.

Savings

Having a substantial amount of savings is viewed positively by mortgage lenders. When you have substantial savings, you’re perceived as a lower-risk borrower because you have a financial cushion to fall back on.

Government Support and Homebuyer Programs

Do you feel like you still cannot afford a mortgage for your home? New Zealand has implemented several government initiatives and programs designed to assist homebuyers in achieving their homeownership goals. These initiatives aim to address the challenges of affordability, especially for first-time buyers, and promote a more accessible housing market.

Kāinga Ora is a New Zealand government agency responsible for housing and urban development. They strive to build better and brighter homes for communities and lives.

Below is a list of ownership options they offer :

- First Home Grants (was called Home Start Grant)

- First Home Loans

- Kāinga Whenua Loans

- Tenant home ownership

- KiwiBuild

See the link for more information.

First Home Grants

You could qualify for a First Home Grant if you’ve contributed to KiwiSaver for three years. The amount you get depends on your income and the type of home you’re buying. You can apply before or after finding a property, but applying early (pre-approval) is advised as it’s quicker.

Click here to see if you are eligible for a First Home Grant.

First Home Loans

Saving up the down payment for your first home can be tough, especially since many lenders ask for at least a 20% deposit. However, with a First Home Loan, you only need a 5% deposit, making it simpler to get your first home.

These loans are given out by certain banks and lenders, with Kāinga Ora backing them. This means lenders can offer loans that might not meet their regular criteria.

If you’re considering a First Home Loan, talk to a lender that offers them. They can help based on what you need and your unique situation.

Click here to see if you are eligible for a First Home Grant.

Kāinga Whenua Loans

The Kāinga Whenua Loan Scheme, a collaboration between Kāinga Ora and Kiwibank, aids Māori in achieving homeownership on collectively owned land. The loans cater to Māori land trusts and individuals with occupancy rights on shared Māori land.

Click here to see if you are eligible for a Kāinga Whenua Loan.

Tenant Home Ownership

If you rent from Kāinga Ora, you might qualify for a grant to help you buy your current home. You might become a homeowner without needing to move.

Click here to see if you are eligible for a Tenant Home Ownership grant.

KiwiBuild

KiwiBuild partners with housing developers to make homes more affordable for first-time buyers and speed up the process of bringing new homes to the market. It helps with projects of all sizes, from single homes to adding affordable options in bigger urban renewal projects.

Click here to see if you are eligible for a Kiwibuild home.

Tools and Resources

Don’t stress about the numbers, and let these online tools do the math for you:

Mortgage calculator

This tool can help you estimate your monthly mortgage payments based on your loan amount, interest rate, loan term and other costs.

- Sorted: Mortgage calculator

- ASB: Mortgage repayment calculator

- Settled: Mortgage calculator

Debt calculator

A debt calculator is designed to help you assess and manage your debt-related financial information.

- Sorted: Debt calculator

- MoneyHub: Personal loan repayment calculator

KiwiSaver calculator

National Capital provides free KiwiSaver advice and can help you choose the right fund for your goals.

- National Capital

Affordability Metrics You Should Understand

In this section, I will break down all the home loan jargon that is important to understand if you want to have successful discussions with any mortgage lender in choosing a loan that aligns with your financial goals and capabilities.

Debt-to-Income Ratio (DTI)

The Debt-to-Income Ratio (DTI) is an important number that lenders use to see if you can handle paying for a mortgage alongside your other debts.

To calculate DTI, sum up all your monthly debt payments and divide that by how much money you earn before monthly taxes.

Let’s say you and your partner have a combined annual gross income of $120,000, each earning $60,000. Your goal is to secure a mortgage of $350,000, and you have $40,000 of existing loans (car loan and credit card). Sum up all your monthly debt payments, e.g. your mortgage of $350,000 plus your car loan and credit card debt of $40,000. This adds up to a total obligation of $390,000. Now, divide this total debt ($390,000) by your combined gross income ($120,000); your DTI is 3.25.

In New Zealand, there are no concrete rules on what your DTI should be if you want to get approved for a home loan, but lenders often prefer a DTI below 4. A lower DTI can enhance your chances of loan approval and better terms.

Loan-to-Value Ratio (LTV)

This ratio looks at how much money you’re borrowing compared to how much the property is worth. The RBNZ, New Zealand’s central bank, uses the LTV to limit how much a bank can lend.

If your LTV is high, meaning you’re borrowing a large chunk of what the house is worth, it can raise concerns for the lender as it means you have a lot more to pay off. On the flip side, a lower LTV implies that you have more skin in the game, making you a more attractive borrower. For homeowners who are putting down a 20% deposit, the LTV you would be given is 80%.

Credit Score

A credit score is like a grade that shows how well you’ve managed your money and debts in the past. It’s a number that helps banks and lenders decide if they should lend you money.

In New Zealand, that number ranges between 0-1000. An average score falls between 500 and 700, and lenders may have to consider other factors before considering you for a home loan. Scores exceeding 700 is a good look. And if you manage to score anything above 900, congratulations, that’s an A+. You are now the lender’s favourite customer.

How to check your credit score (New Zealand):

- Centrix

- Credit simple

- My Credit File

Conclusion

In the journey towards owning a home, understanding mortgage affordability is crucial. It’s not just about doing math; it’s about matching your money situation with your dream of having a house. By carefully considering how much you earn, spend, and owe and how the housing market changes, you ensure your mortgage fits well with your overall financial outlook.

Even if the housing market and interest rates change, thinking about what you can afford for a mortgage helps you have a stable financial foundation for the future. Whether buying your first home or you’ve done it before, remember that smart money decisions today lead to a comfy and happy tomorrow.

References

- https://www.rbnz.govt.nz/statistics/series/exchange-and-interest-rates/new-residential-mortgage-standard-interest-rates

- https://www.omnicalculator.com/finance/28-36-rule

- https://www.beehive.govt.nz/release/government-takes-further-steps-improving-safe-access-credit

- https://kaingaora.govt.nz/home-ownership/first-home-decision-tool/?gclid=Cj0KCQjwldKmBhCCARIsAP-0rfyjcl9qQ8XQ0g29UvIFW8Wp0X0bTdKfl1-X33rC7HJu0_vklHDKVZcaApwWEALw_wcB&gclsrc=aw.ds

- https://www.govt.nz/browse/housing-and-property/buying-or-selling-a-home/buying-your-first-home/

- https://www.investopedia.com/terms/d/dti.asp#:~:text=for%20a%20mortgage.-,Ideally%2C%20lenders%20prefer%20a%20debt%2Dto%2Dincome%20ratio%20lower,a%20mortgage%20or%20rent%20payment.

- https://mortgages.co.nz/what-credit-score-do-i-need-to-buy-a-house-in-new-zealand/

- https://www.rbnz.govt.nz/regulation-and-supervision/oversight-of-banks/standards-and-requirements-for-banks/macroprudential-policy/loan-to-value-ratio-restrictions

- https://www.kiwibank.co.nz/personal-banking/home-loans/guides-and-calculators/whats-lvr/#:~:text=Owner%2Doccupiers%3A,the%20First%20Home%20Loan%20initiative.

- https://mortgagelab.co.nz/how-much-deposit-do-you-need-to-buy-your-first home/#:~:text=What%20is%20the%20minimum%20deposit,for%20a%20turn%2Dkey%20build.

- https://www.homeloanexperts.com.au/home-loan-articles/debt-to-income-ratio/

- https://www.beehive.govt.nz/release/government-takes-further-steps-improving-safe-access-credit

- https://www.homeloanexperts.com.au/home-loan-articles/debt-to-income-ratio/

- https://mortgages.co.nz/what-credit-score-do-i-need-to-buy-a-house-in-new-zealand/