If you're like most people, your home is your biggest asset. So when it comes time to refinance your mortgage, it's essential to get it right

Mortgages, a long-term bind

Fixed or variable, one must find

The right fit, with care.

– A haiku on mortgages. Author unknown.

If you’re like most people, your home is your biggest asset. So when it comes time to refinance your mortgage, it’s essential to get it right. Choosing the right term can save you thousands of dollars in interest over the life of your loan.

In New Zealand, the common terms can go from floating mortgages where you are not fixed into any term, right to a 5-year fixed term. Some banks offer a longer term from time to time, but they are very uncommon.

But with so many options available, how do you know which is right for you?

In this post, we’ll explore the different factors to consider when choosing a mortgage term so that you can make the best decision for your situation. Read on to learn more!

Let’s start by analysing current interest rates

In New Zealand, mortgage interest rates were quite favourable for borrowers until recently. For example, one of the lowest home loan rates was 2.75%, a great deal for those looking to buy or refinance. However, at that stage, people were told it’s essential to remember that these rates are variable and can change over time.

And that’s exactly what happened. Interest rates have been rising recently as the global economy continues to strengthen. This has led to increased borrowing costs for both consumers and businesses alike.

At the time of writing, TSB bank has a floating rate of 8.75% – quite a jump!

So does this mean it’s as high as it can go?

It is important to beware of the assumption that interest rates cannot rise from these current levels. While it is true that interest rates are at a high compared to the historically low levels in recent years, looking back a bit further gives us an accurate picture of what the possibilities are.

We may think that interest rates have peaked, but this is not necessarily true. Rates are unpredictable, and there is no telling when mortgage rates could increase. Historical mortgage rates in New Zealand have fluctuated quite drastically over the last few decades. In the 1980s, New Zealand experienced a period of rapid economic change known as Rogernomics, which took interest rates to more than 20%.

So what factors can make it go higher? One is the New Zealand Official Cash Rate (OCR), which leads us to our next question.

What direction is the OCR predicted to go?

The New Zealand Official Cash Rate (OCR) is the interest rate set by the Reserve Bank of New Zealand (RBNZ) and is used as a benchmark for short-term interest rates in the country. The RBNZ reviews the OCR periodically and adjusts it to meet its policy objectives.

It is important to note that predicting the direction of the OCR is difficult, as it depends on a wide range of economic and financial factors.

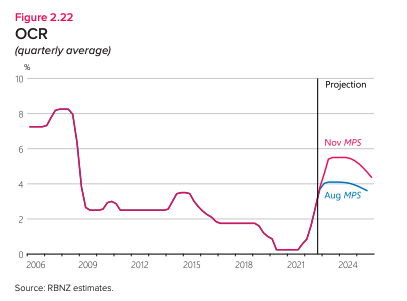

But let’s see what the RBNZ itself has to say about the future of the OCR. We can read the OCR track to get that information. This is a forecast the bank releases every three months showing where they might move the OCR based on their current estimates.

According to their latest estimate, the OCR is predicted to go slightly higher than it currently is before levelling off. But pay attention to the blue line. That was the RBNZ projection in August 2022. At that time, they expected the future OCR to be lower but had to change their estimates.

So if the people who set the OCR can get it wrong, is there any point in us trying to estimate what and how high the OCR will go in the long term?

Why was the mortgage so confused?

Have banks priced in high OCR?

Banks and other financial institutions typically use the OCR as a reference point when setting the interest rates they charge on loans and other financial products. However, it is difficult to know whether banks have priced in the possibility of a higher official cash rate (OCR) in their financial planning, as this information is typically not publicly available.

That being said, it is likely that banks and other financial institutions consider a wide range of factors when setting their interest rates, including the OCR, as well as other economic and financial conditions. It is always important for banks and other financial institutions to be mindful of potential changes in interest rates and to make sure their financial planning takes these potential changes into account.

Looking back, we see that banks have always followed the OCR up or down, so it seems that they do not try to set rates based on future OCR but rather on the current OCR. I guess the smart people at the banks have realised that if the RBNZ cannot predict the OCR, perhaps they should not either. Of course, that does not stop them from publishing their predictions in the media, but that’s a different story.

I’m hearing you say at this point – “So, no one knows where mortgage rates are going. I get it. But that doesn’t help me answer my question of what term should I refix my mortgage for?”

Perhaps the next few paragraphs will help you answer your question better.

What’s your cash flow looking like?

Your cash flow, or the amount of money coming in and going out of your personal finances, can affect your ability to make mortgage payments in several ways. If you have a stable and consistent cash flow, with a sufficient amount of income to cover your expenses, you may be more likely to be able to afford your mortgage payments on time. On the other hand, if your cash flow is unstable or insufficient, you may struggle to make your mortgage payments, which could lead to financial difficulties.

A longer-term mortgage means that your monthly mortgage payments will remain the same for a while, regardless of changes in market interest rates. This can be a good choice if you want the stability and predictability of knowing what your mortgage payments will be each month. This should be attractive if your cash flow is already tight, and you know you will struggle if mortgage rates rise much further than they already are.

On the other hand, a short-term mortgage means your interest rate will fluctuate a lot more depending on changes in the OCR. This can be a good choice if you expect interest rates to decrease over the short term and have the additional cash flow to still afford to pay your mortgage if your prediction is wrong.

So to summarise, if you can afford the risk – you may save some money by going short term – but if you can’t, then perhaps stumping up the extra interest rates for the stability of fixing it long term may be a good idea.

Important

A financial professional or a counsellor can help you review your financial situation and make a plan to get your finances back on track.

Size of your loan, go for gold or slow and steady?

The size of your loan can be a factor to consider when deciding between a short-term or long-term rate. The larger the loan compared to your assets and income, the more likely it is that a rise in interest rates will substantially and negatively impact your cash flow.

Whereas, if you have a smaller loan – you could take the risk associated with shorter terms and predicting interest rates.

Your personal risk tolerance

Personal risk tolerance refers to your willingness and ability to accept financial risk. It is an important factor to consider when making financial decisions, as it can impact the types of investments and financial products most suitable for you. Risk tolerance can vary from person to person and can be influenced by factors such as your age, financial goals, financial situation, and personal comfort level with uncertainty.

For example, an individual who is young and has a long time horizon until retirement may have a higher risk tolerance. This person may be more comfortable with decisions that have the potential for higher returns but also come with a higher level of risk. On the other hand, an individual closer to retirement may have a lower risk tolerance, as they have less time to recover from potential losses. This person may be more comfortable with making decisions to reduce their level of risk, even if it means paying a bit more interest.

So your risk tolerance will also play a part in deciding between a short-term and long-term rate. Do you value a good night’s sleep over a few dollars more or vice-versa?

Your broader financial strategy

Considering your broader financial strategy is essential when deciding how long to fix your mortgage. A mortgage is a significant financial commitment, and it is vital to ensure it aligns with your overall financial goals and priorities.

Here are a few ways in which your financial strategy can impact your decision on how long to fix your mortgage for:

Other investments

When deciding how to allocate your financial resources, it can be helpful to consider the trade-offs between investing in other assets, such as stocks or real estate, and how you pay off your mortgage. There are several factors to consider when making this decision, including risk, return on investment, tax considerations, and personal circumstances. For example, if you have money invested in a volatile investment that is expected to earn a much higher return than the current long-term mortgage rate, is it a good idea to fix it for longer and not have to take the risk of having to draw down on your other investment too early?

Paying off the mortgage quickly

If one of your financial goals is to pay off your mortgage as quickly as possible, you may want to consider a shorter-term fixed mortgage. This can help you repay lump sums quickly, save on interest costs over the long term, and pay off the mortgage more quickly.

Managing cash flow

As mentioned before, your cash flow, or the amount of money coming in and going out of your personal finances, can also be a factor in deciding how long to fix your mortgage for. A longer-term fixed mortgage may be a good choice if you don’t have a stable and consistent cash flow, as it can provide stability and predictability in your monthly mortgage payments. On the other hand, if your cash flow is more uncertain or volatile, a longer-term fixed mortgage may be a better fit.

Can I just fix it for a longer term and then break the loan and move to a shorter term if interest rates fall?

Breaking a home loan term, also known as breaking a mortgage, refers to ending a mortgage contract before the end of the agreed-upon term. Other than getting a better rate, there are several reasons why an individual may want to break a home loan term, such as selling the property, refinancing the mortgage, or experiencing financial difficulties that make it challenging to make the mortgage payments.

If you want to break a home loan term, you will typically need to pay a penalty, known as a mortgage discharge fee or a mortgage break fee. The amount of the penalty will depend on the terms of your mortgage contract and the specific circumstances of your case. The penalty is intended to compensate the lender for the costs associated with breaking the mortgage early, such as re-selling the mortgage on the financial market.

It is crucial to consider the potential consequences of breaking a home loan term, as it can be costly. In addition to paying a penalty, breaking a mortgage may also impact your credit score and your ability to obtain financing in the future. If you are having difficulty making your mortgage payments or want to break a loan to get a better rate, it is vital to speak to your lender or a mortgage adviser as soon as possible to discuss your options. It’s a decision that should be taken with care.

In summary

There are several factors to consider when deciding how long to fix your mortgage for, including:

Your financial situation: It is essential to carefully consider your own financial situation when deciding how long to fix your mortgage. Factors to consider may include your cash flow, debt levels, and financial goals.

Your risk tolerance: Your risk tolerance, or willingness and ability to accept financial risk, can also be a factor in deciding how long to fix your mortgage. If you have a low-risk tolerance, you may prefer the stability and predictability of a longer-term fixed mortgage.

Interest rates: The current interest rate environment should be considered when deciding how long to fix your mortgage. If interest rates are expected to rise in the near future, you may want to consider a longer-term fixed mortgage to lock in a lower rate.

Your expected time horizon: Your expected time horizon, or the length of time you expect to keep the mortgage, can also determine how long to fix your mortgage. If you expect to sell the property or refinance the mortgage in the near future, a shorter-term fixed mortgage may be more suitable.

Your financial strategy: Your overall financial strategy is essential in deciding how long to fix your mortgage. For example, you may have a strategy of paying off your mortgage as quickly as possible, in which case a shorter-term fixed mortgage may be more suitable.

And it is always a good idea to speak with a financial professional or a mortgage specialist to help you understand your options and make an informed decision.

Why was the mortgage broker unhappy?

COMMENTS