Discover various compensation models for financial advisors in New Zealand and learn insights into fee-only, commission-based, mixed, and performance-based structures.

Hiring a financial advisor is like booking a ride with a taxi service. Before you get in the car, you’d want to know how the fare is calculated so you are not unfairly charged. Similarly, understanding how financial advisors earn their income is like checking the fare before your ride – it helps you gauge potential conflicts of interest, assess costs, and align their incentives with your financial goals.

The financial advisory industry in New Zealand is a regulated sector. Advisors must meet high standards to protect consumers. They provide various compensation options, and their main goal is to help clients reach their financial goals.

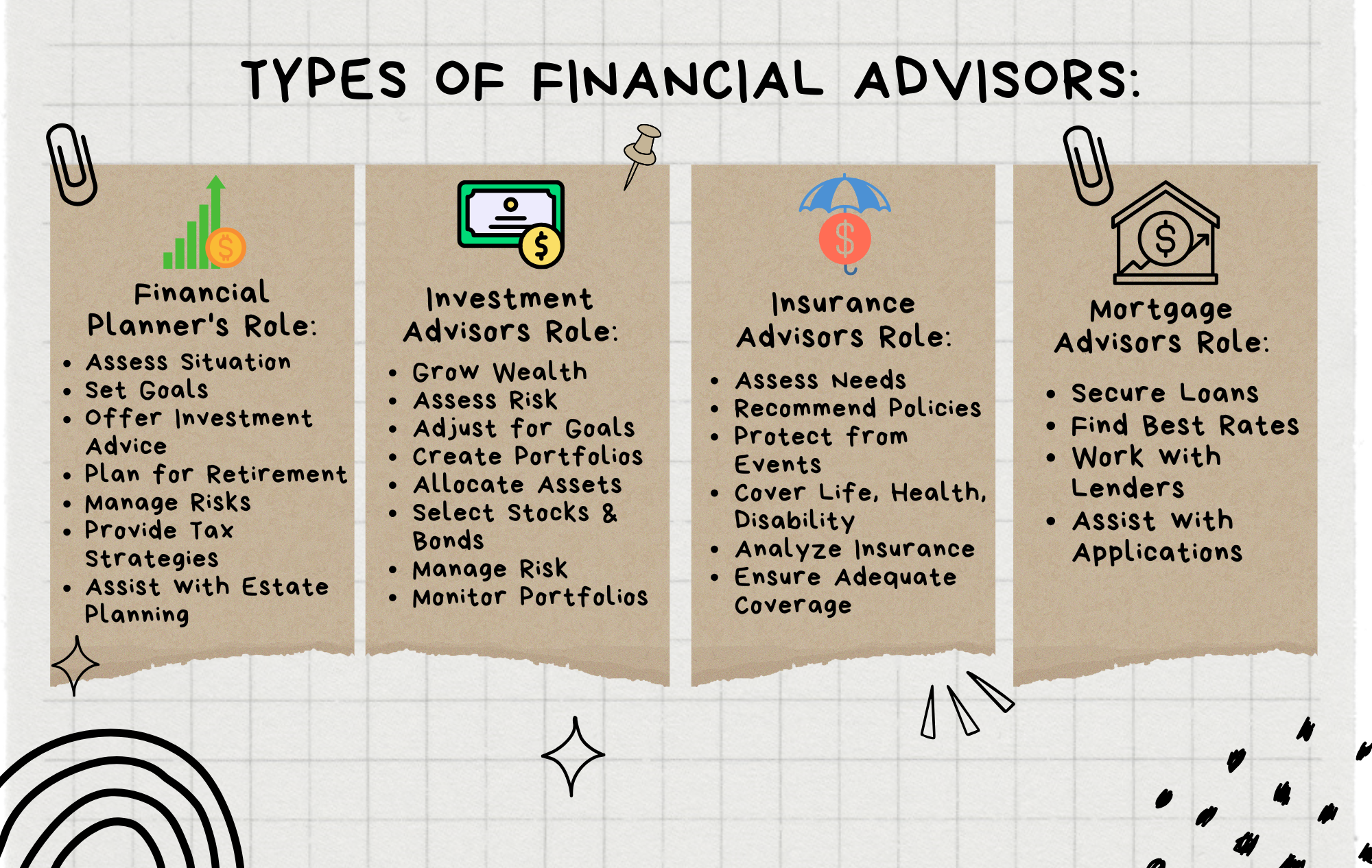

Types of Financial Advisors

Financial Planners

A financial planner’s core duty is to help clients achieve financial goals by creating a tailored financial plan. This can be achieved through assessing their situation, setting objectives, offering investment advice, planning for retirement, managing risks, providing tax strategies, and assisting with estate planning.

Investment Advisors

Investment advisors help clients manage and optimise investment portfolios to grow wealth, assess risk and adjust for financial goals. They provide investment management services, including portfolio creation, asset allocation, stock and bond selection, risk management, and ongoing portfolio monitoring.

Insurance Advisors

Insurance advisors specialise in assessing clients’ insurance needs and recommending appropriate policies to protect against unforeseen events. They ensure clients are adequately covered for life, health, disability, and long-term care insurance. They focus on insurance analysis, evaluating client needs, and suggesting appropriate policies to ensure adequate coverage.

Mortgage Brokers

Mortgage brokers help clients secure mortgage loans for property purchases or refinancing. They find the best rates and terms by working with multiple lenders. They assist with mortgage loan origination, financial situation assessment, identifying suitable options, and facilitating the application and approval process.

Fee-Only Compensation

Think of fee-only advisors like a personal chef you hire and pay directly to cook meals for you. They focus on your tastes and preferences without trying to sell you specific ingredients, ensuring the dishes are tailored to your liking without any ulterior motives.

Fee-only advisors are paid by their clients through fees and don’t earn money from product sales, preventing conflicts of interest in their advice.

Advantages of working with fee-only advisors:

- Objective Advice: Fee-only advisors provide impartial guidance since they don’t earn money from specific financial products, promoting unbiased recommendations.

- Client-Centred: Their focus is solely on the client’s financial well-being, aligning their interests with those of their clients.

- Transparency: Clients know exactly what they are paying for, promoting trust and clarity in the advisory relationship.

Challenges and drawbacks with fee-only advisors:

- Cost: Fee-only advisors charge for their services, which can be pricier than commission-based advisors, making them less accessible for some clients.

- Accessibility: High fees might discourage individuals with smaller portfolios from using their services.

- No Product Access: Fee-only advisors don’t provide financial products, so clients must execute their recommended strategies on their own.

Commission-Based Compensation

Commission-based compensation means financial advisors get paid a percentage of the money clients invest or spend on certain financial products they sell, and the more they sell, the more they earn.

How commissions work

When advisors sell certain financial products to clients, they earn a percentage of the money clients invest or spend on those products. These commissions are usually paid by the product provider, not the client directly. The amount advisors earn can vary based on factors like the type of product and their sales agreements. So, the more they sell, the more they make. This system ties an advisor’s income to their sales performance and can influence the products they recommend.

There are various types of commissions in the financial industry. Investment advisors may earn commissions on mutual funds or stocks they sell, while insurance advisors receive commissions for selling insurance policies such as life, health, or auto insurance.

Factors influencing commission rates

Advisors can get different commission rates, which depend on the type of product, the provider, their agreements with their employer, and how well they sell. Factors like how complicated the product is and how many sales they make can affect these rates.

Potential Conflicts of Interest

One potential conflict of interest in commission-based models is that advisors may be incentivised to recommend financial products that offer higher commissions, even if they may not best fit the client’s needs. This could lead to biased advice and recommendations.

Regulators set rules to deal with these conflicts. Advisors must reveal how they’re paid, act in clients’ best interests (called fiduciary duty), and not recommend just to earn commissions.

Mixed Compensation Models

Mixed compensation models are a common way financial advisors get paid, offering a middle-ground approach that combines fees for their advice with commissions from selling financial products. This hybrid model, used by many advisors, aims to strike a balance between fee-based transparency and commission-based earnings, providing clients with a range of services while considering potential conflicts of interest.

Benefits

Hybrid models offer clear fees and access to products, giving personalized advice and cost-effective planning for clients.

Considerations:

In hybrid models, clients should watch out for possible conflicts. Advisors might suggest products with higher commissions and not necessarily the best fit. To handle this, clients should choose advisors who prioritise their interests, share how they’re paid, and give clear recommendations.

Examples of Mixed Compensation Models

- Investment Advisors: These advisors may charge clients a fee for creating and managing investment portfolios while also earning commissions from product sales like mutual funds or stocks.

- Insurance Advisors: Insurance advisors might receive fees for insurance analysis and recommendations, but they can also earn commissions from selling insurance policies such as life, health, or auto insurance.

- Financial Planners: Financial planners may provide comprehensive financial planning services for a fee, and they may also earn commissions from recommending various financial products like retirement plans or investment options.

Salary and Retainer Models

Advisors on Salary

Advisors on salary get a steady paycheck from their employer, no matter what they sell or how many clients they have. It’s like a regular job with a fixed income, unlike advisors who earn money from commissions or client fees.

Advantages:

- Stability: Clients benefit from consistent and predictable costs for financial advice, as fees are often fixed.

- Objective Advice: Advisors on salary may be perceived as providing more objective advice, as their income is not directly tied to product sales or commissions.

- Reduced Sales Pressure: Clients typically experience less pressure to make financial transactions, allowing them to focus on their financial goals.

Disadvantages:

- Limited Product Range: Advisors on salary may have restrictions on the range of financial products they can offer, potentially limiting investment options.

- Potential for Less Incentive: Some clients may be concerned that advisors on salary have less incentive to actively manage their investments or may not be as motivated to provide exceptional service.

Retainer-Based Advisors

Retainer-based advisors charge a regular fee like a subscription for their services. Clients pay a set amount, such as monthly or yearly, to keep working with the advisor. This model is predictable and often covers various financial planning services.

Structure and Billing of Retainer Fees:

Retainer fees are typically structured as recurring payments, similar to subscription services. Clients may choose between monthly, quarterly, semi-annual, or annual billing cycles, depending on their preferences and the advisor’s policies. The fee amount is agreed upon in advance and remains consistent throughout the chosen duration of the advisory relationship. Payments are often automated to ensure convenience and timeliness.

Performance-Based Compensation

Performance-based fees are a compensation structure used in the financial industry, particularly in investment management. Performance-based compensation is when advisors get paid based on how well they do their job or meet clients’ goals. Unlike regular salaries or hourly wages, their earnings depend on their performance results. If the manager does better than the goal, they get a bonus based on the extra money they make. But they don’t get any extra money if they don’t meet the goal. This structure is particularly used in investment management.

Factors Influencing the Structure of Performance-Based Compensation:

- Benchmark Selection: The choice of benchmark or performance target significantly impacts the calculation of performance fees. The more challenging the benchmark, the higher the hurdle for earning a fee.

- Fee Percentage: The percentage of investment gains that the advisor can earn as a fee varies among funds and managers. It’s often set as a portion of the excess returns beyond the benchmark.

- High-Water Mark: Many performance fee structures include a high-water mark provision, ensuring that the advisor earns a fee only on new gains that surpass previous performance highs.

- Lock-Up Periods: Some performance fee arrangements include lock-up periods, during which investors cannot redeem their investments, aligning their interests with the advisor’s longer-term performance goals.

- Clawback Provisions: In certain cases, performance fees may be subject to clawback provisions, allowing investors to recover previously paid fees if the investment underperforms over time.

Advantages:

- Motivates Advisors: Performance-based compensation motivates financial advisors to work hard and make smart choices to help clients earn more money. This can create a stronger and more committed advisory partnership.

- Aligns Interests: When advisors earn more when clients do well, their interests are aligned with those of their clients. This reduces conflicts of interest and fosters a focus on achieving clients’ financial goals.

- Potential for Higher Returns: If advisors exceed performance targets, clients can benefit from higher returns on their investments, providing an opportunity for increased wealth.

Disadvantages:

- Risk of Excessive Risk-Taking: Advisors may take on excessive risks in pursuit of high returns, potentially endangering clients’ investments.

- Conflicts of Interest: The pursuit of performance fees can sometimes lead to conflicts of interest, as advisors may prioritize their compensation over clients’ best interests.

Regulatory Framework

In New Zealand, organisations like the Financial Markets Authority (FMA) and the Reserve Bank of New Zealand (RBNZ), make sure financial advisors follow the rules and treat clients fairly.

Financial advisors are legally responsible for revealing how they get paid to their clients, ensuring transparency and trust in their relationships. This disclosure helps clients make informed choices and understand any potential conflicts of interest, ultimately safeguarding their financial interests.

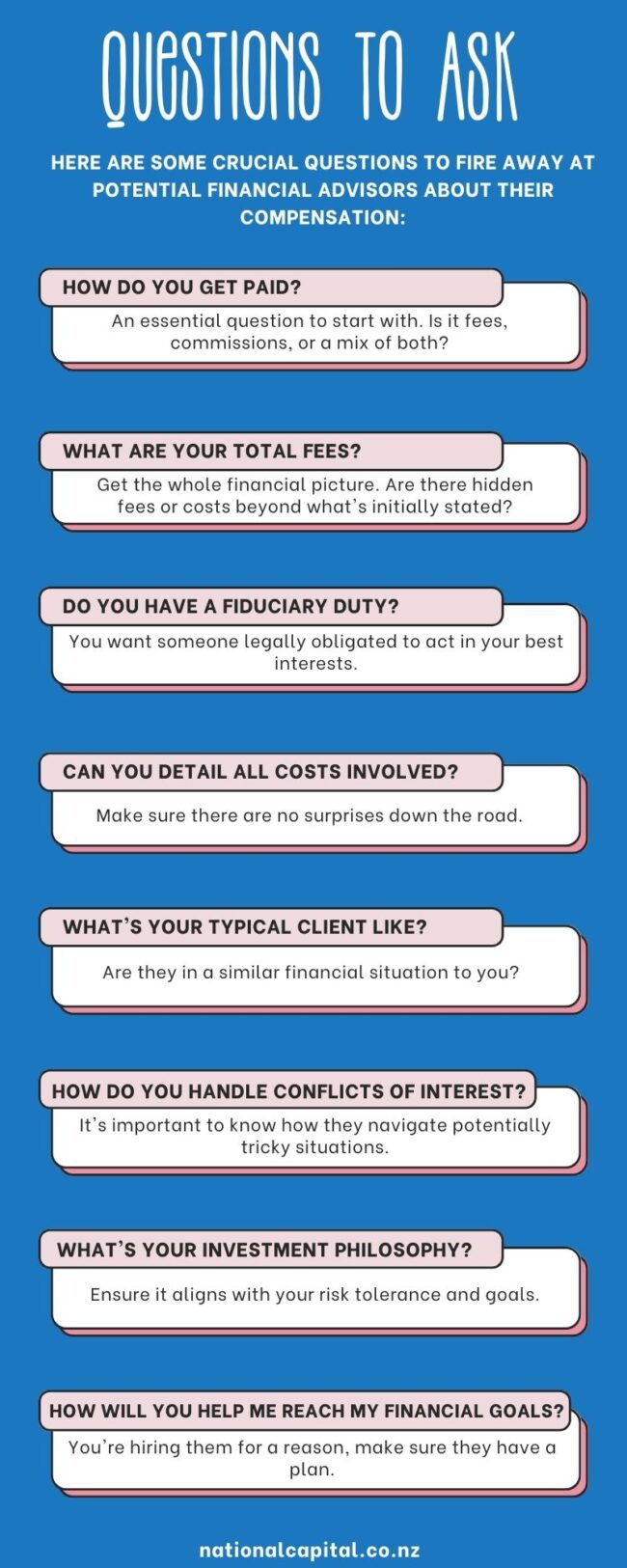

Choosing the Right Financial Advisor

Factors to Consider

Credentials and Qualifications: Ensure the advisor has the necessary certifications and qualifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Experience: Evaluate the advisor’s experience, especially in areas relevant to your financial goals, such as retirement planning or investment management.

Compensation Structure: Understand how the advisor is compensated. Consider whether their fees, commissions, or other charges align with your preferences and financial situation.

Fiduciary Duty: Determine if the advisor is a fiduciary, legally obligated to act in your best interests. This ensures they prioritize your financial well-being.

Communication and Accessibility: Consider the advisor’s communication style and availability. Effective communication is vital for a successful advisory relationship.

Fees and Costs: Be clear about all fees and costs associated with the advisor’s services. Compare these with your budget and financial objectives.

Track Record: Inquire about the advisor’s track record and performance in achieving financial goals for clients similar to you.

Regulatory Compliance: Ensure the advisor is in good standing with relevant regulatory bodies and has no history of disciplinary actions.

Conclusion

Understanding how financial advisors get paid is crucial for protecting your money. In New Zealand, there are different ways advisors are paid, each with pros and cons. You should pick the one that suits you best and aligns with your financial goals.

When choosing an advisor, look at their qualifications, experience, how they get paid, and if they put your interests first. Asking the right questions helps you make smart choices and build a reliable advisor-client relationship for your financial well-being.