Car insurance is a type of insurance that provides financial protection for damages or injuries that you or another driver may cause while operating a vehicle.

You’re driving on an open road. The conditions are fine, the speed limit is not exceeded, and your car is fit to drive. Suddenly, you lose steering and hit a fence. You come out relatively unscathed, with a minor concussion but a badly damaged car. It looks like oil on the road caused your car to lose traction and spin out of control.

You might be an excellent driver or an average one. However, accidents happen. Sometimes, they are out of your control. Will you have insurance to protect you financially in times like these?

What is car insurance, and how does it work?

Car insurance, oh car insurance

A necessary evil, we must admit

It protects us from financial ruin

When accidents and mishaps do occur

Without it, we’d be left to pay

For damages to our car or someone else’s

But with it, we’re covered and secure

In the event of an unexpected turn

So let’s not skimp on car insurance

But choose a policy that’s right

For our car, our budget, and our peace of mind

It’s a small price to pay for protection divine

Ok, enough with the bad poetry. Let’s get to it.

Insurance is a way to financially protect ourselves from unexpected events or disasters, such as accidents or natural disasters, by paying a premium. This premium allows you to receive reimbursement for any assets that may be lost or damaged. The premiums paid by all policyholders, including yourself, contribute to a pool of money from which claims can be made. This means that the insurance coverage of one individual relies on the premiums many individuals pay. Similarly, other policyholders may also be able to claim this pool if they experience a loss or damage to their assets.

It is crucial to remember that your insurance policy might not be the same as those of other people. As a result, things covered by your policy might not be covered by another person’s, and vice versa. As a result, you should speak with your insurance provider until you fully comprehend how you would be covered if these catastrophes occur.

Car insurance is a type of insurance that provides financial protection for damages or injuries that you or another driver may cause while operating a vehicle. It also protects against damages to your vehicle caused by incidents such as accidents, theft, or natural disasters.

There are various types of car insurance coverage options available, and the specific coverage you choose will depend on your needs and government requirements. Some common types of car insurance coverage include

- Liability coverage: This coverage protects you financially if you are found to be at fault in an accident and are sued by the other party. It typically includes two types of coverage: bodily injury liability and property damage liability.

- Collision coverage: This coverage pays for damages to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive coverage: This coverage pays for damages to your vehicle caused by events other than an accident, such as theft, natural disasters, or vandalism.

- Medical coverage: This coverage pays for medical expenses for you and your passengers if you are involved in an accident.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

To obtain car insurance, you will typically need to provide information about yourself, your vehicle, and your driving history. Your insurance company will use this information to assess the risk of insuring you and will use it to determine the premium you will need to pay for your coverage. The premium is the amount you will need to pay for your insurance coverage regularly, typically monthly or annually.

In the event of an accident or other covered event, you will need to file a claim with your insurance company. The company will then investigate the claim and determine whether or not it is covered under your policy. If the claim is approved, the insurance company will pay for the damages or losses up to the limits of your policy.

What are the different types of car insurance in New Zealand?

Several types of car insurance coverage are available in New Zealand, including

- Third-party insurance: This is the minimum recommended level of coverage in New Zealand. It covers damages or injuries you cause to another person or their property while driving. It does not cover damages to your vehicle.

- Third-party, fire and theft insurance: This type of coverage provides the same protection as third-party insurance but also covers damages to your vehicle caused by fire or theft.

- Comprehensive insurance: This is the highest car insurance coverage available in New Zealand. It provides the same protection as third-party, fire and theft insurance. Still, it also covers damages to your vehicle caused by any other covered event, such as an accident or natural disaster.

In addition to these types of coverage, some New Zealand car insurance policies may include additional options, such as

- Windscreen cover: This covers repairing or replacing your windscreen if damaged.

- Medical expenses cover: This covers the cost of medical treatment for you and your passengers if you are involved in an accident.

- Rentals and travel expenses cover: This covers the cost of rental car expenses or travel expenses if you cannot use your vehicle due to a covered event.

- No-claims bonus protection: This protects your no-claims bonus if you claim your policy.

It is essential to carefully consider your insurance needs and choose a policy that provides the coverage you need. You should also be aware that the specific coverage options and the cost of car insurance can vary depending on the insurer you choose.

Advantages of car insurance

We have briefly discussed what insurance is and how to use it. But at this point, you may ask what the advantages and disadvantages are.

We’ve lsited a few benefits of car insurance below.

- Financial protection: Car insurance provides financial protection in an accident or other covered event. Without insurance, you would be responsible for paying for any damages or injuries that you cause to another person or their property.

- Peace of mind: Car insurance can provide peace of mind knowing that you are protected in an accident or other covered event. This can allow you to drive confidently, knowing you have a safety net in an unexpected situation.

- Flexibility: Car insurance policies often come with various coverage options, so you can customise your policy to suit your specific needs and budget.

- Professional support: If you have car insurance, you have access to a team of professionals who can help you navigate the claims process and get you back on the road as quickly as possible.

- Discounts: Some car insurance companies offer discounts for safe driving, multiple cars, and multiple policies.

Disadvantages of car insurance

With advantages come disadvantages. Despite the advantages being significant, consumers need to understand the disadvantages to make educated decisions about which plan is the most suitable for them, if any plan at all. Possible disadvantages are listed below:

- Cost: Car insurance can be expensive, especially for drivers who are considered to be high-risk. This can be a burden for those on a tight budget.

- Coverage limits: Even with comprehensive coverage, there may be limits to the amount your insurance company will pay for damages or losses. You may still be responsible for paying some of the costs out of pocket.

- Exclusions: Most car insurance policies have exclusions, which are events or circumstances not covered under the policy. This means that if you are involved in an accident or other covered event that is explicitly excluded, you may not be able to make a claim.

- Claims process: Claiming your car insurance can be complex and time-consuming. You may need to provide a lot of information and documentation, which can take time for your claim to be processed and approved.

- Premium increases: If you claim car insurance, your premium may increase. Insurance companies consider claims history when determining the risk of insuring a driver, and a history of claims can increase the risk.

Car insurance providers in NZ

There are various car insurance providers for consumers in New Zealand. Each provider offers slightly different plans when taking the fees charged into consideration. Here are a few of New Zealand’s most popular providers.

- State Insurance

- AA Insurance

- AMI Insurance

- Tower Insurance

- Vero Insurance

- Trade Me Insurance

- BNZ Insurance

- Westpac Insurance

To determine which company offers the best service and value, Finder polled 1300 New Zealand drivers who were 18 years of age or older about their auto insurance.

Additionally, Canstar surveyed more providers than Finder. Both are analysed below.

Participants rated their current or most recent provider based on overall happiness, online experience, how simple their policy is to comprehend, and the likelihood of suggesting the insurance.

| Provider | Finder (score out of 5) | Canstar (score out of 5) |

| FMG | – | 5 |

| Trade Me | 4.41 | 4 |

| AA | 4.25 | 4 |

| State | 4.00 | 4 |

| AMI | 3.98 | 4 |

| BNZ | 3.84 | 4 |

| Westpac | 3.71 | 3 |

| Vero | 3.70 | 3 |

| Tower | 3.65 | 3 |

| ANZ | – | 3 |

| ASB | – | 3 |

| AMP | – | 3 |

Canstar and Finder produced consistent results. Both surveys showed Trade Me is ranked highly, along with AA, State, AMI and BNZ. They also suggest Tower and Vero are low ranking and, perhaps, not as satisfactory compared to their competitors.

Canstar highlights the popularity of FMG – having a five-star rating, higher than Trade Me. Canstar also gives ANZ, ASB and AMP poor ratings relative to competitors – all having three stars.

Why was the car insurance salesman feeling depressed?

Factors affecting insurance premiums

Different models of vehicles will have different insurance premiums. The following factors dictate the premium that different consumers pay.

- Repair costs: Insurance premiums are based partly on the anticipated costs of repairing or replacing a vehicle in the event of an accident. Some vehicle models may be more expensive to repair due to the cost of parts or the complexity of the repairs. These vehicles may have higher insurance premiums as a result.

- Safety ratings: Insurance premiums may also be influenced by a vehicle’s safety ratings. Vehicles with good safety ratings are less likely to be involved in accidents and may have lower insurance premiums.

- Vehicle value: The value of a vehicle can also affect insurance premiums. Vehicles with a higher value may have higher premiums because they are more expensive to repair or replace.

- Risk of theft: Insurance premiums may also be influenced by the risk of theft. Vehicles that are more likely to be stolen may have higher premiums because they are more expensive to replace if they are stolen. Examples include Mazdas and Subarus due to their higher rates of theft.

- Driver profile: Insurance premiums may also vary based on the driver’s profile, including their age, driving history, and location. For example, a younger, inexperienced driver may pay higher premiums than an older, more experienced driver.

How different vehicles affect insurance premiums

As discussed, a significant factor affecting your insurance premium is the model of the car you drive. NerdWallet analysed the 25 best-selling car models from last year in America, according to the Kelley Blue Book, and looked at their insurance costs against their retail price. The insurance as % of MSRP highlights this ratio as a percentage.

| Rank | Average annual insurance premium |

MSRP | Insurance as % of MSRP |

| 1. Subaru Outback | $1,336 | $26,945 | 5.0% |

| 2. Subaru Forester | $1,347 | $25,195 | 5.3% |

| 3. Honda CR-V | $1,359 | $26,400 | 5.1% |

| 4. Jeep Wrangler | $1,406 | $29,725 | 4.7% |

| 5. Hyundai Tucson | $1,406 | $25,500 | 5.5% |

| 6. Mazda CX-5 | $1,412 | $25,900 | 5.5% |

| 7. Ford Escape | $1,427 | $26,010 | 5.5% |

| 8. Honda Pilot | $1,442 | $37,580 | 3.8% |

| 9. Chevrolet Equinox | $1,459 | $25,800 | 5.7% |

| 10. Ford F-150 | $1,465 | $29,990 | 4.9% |

| 11. Toyota RAV4 | $1,472 | $26,525 | 5.5% |

| 12. Toyota Tacoma | $1,477 | $26,700 | 5.5% |

| 13. Chevrolet Silverado 1500 | $1,524 | $29,300 | 5.2% |

| 15. Toyota 4Runner | $1,534 | $37,605 | 4.1% |

| 16. Jeep Grand Cherokee | $1,543 | $37,785 | 4.1% |

| 17. Ford Explorer | $1,570 | $33,245 | 4.7% |

| 18. Honda Accord | $1,601 | $26,120 | 6.1% |

| 19. Honda Civic | $1,603 | $22,350 | 7.2% |

| 20. GMC Sierra 1500 | $1,606 | $32,895 | 4.9% |

| 21. Toyota Highlander | $1,617 | $35,405 | 4.6% |

| 22. Toyota Corolla | $1,623 | $20,175 | 8.0% |

| 23. Toyota Camry | $1,641 | $25,395 | 6.5% |

| 24. Dodge Ram 1500 | $1,641 | $35,200 | 4.7% |

| 25. Tesla Model Y | $2,268 | $60,990 | 3.7% |

The table shows cheaper cars are not always cheap to insure relative to their retail price. Before purchasing a car in New Zealand, research is required to understand what car models are the cheapest to insure and if low insurance costs are a personal priority.

My car is a dunger! Do I still need insurance?

If you own a car that is not worth a lot of money, you may be considering not purchasing insurance because the annual excess may be a lot compared to the cost of your car. However, it is essential to consider that when an accident occurs, and you’re at fault, you are responsible for meeting the other party’s financial obligations. You may drive a 1980 Toyota Corolla, but if you crash into someone’s BMW – you could be on the hook to pay for their expensive repairs. If you do not have insurance, you will be in debt to pay off the expensive car, which is a significant financial burden.

Instead of not insuring your car at all, you should consider investing in third-party insurance. This entails paying cheaper annual insurance as it does not cover the costs of your vehicle. However, it does cover the third party’s costs if you have an accident. In this case, your Corolla will not be covered, but the insurance company will cover the costs of the BMW, relieving the financial burden discussed earlier.

What do Kiwis, in general, think of car insurance?

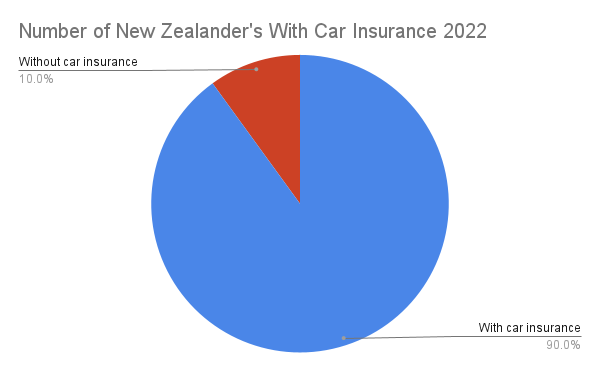

According to Canstar, more than 90% of Kiwis have some coverage even though vehicle insurance is optional in New Zealand, whether it’s a fundamental third-party or comprehensive policy.

Most New Zealand citizens seek financial security in this form. However, even with this information, you must weigh the pros and cons of car insurance to understand its appropriateness for you and what plan best suits your needs. As stated, plans are personalised, and premiums will change between individuals. Furthermore, it is best to speak with an insurance broker to understand the plan’s optimal benefits.

To summarise

Car insurance is recommended to provide financial security and peace of mind surrounding incidents and accidents that don’t often but can occur. The advantages and disadvantages of each plan (and add-ons) need to be considered to understand which plan is the most suitable for your needs. This can quickly be done by talking to an insurance adviser.

COMMENTS